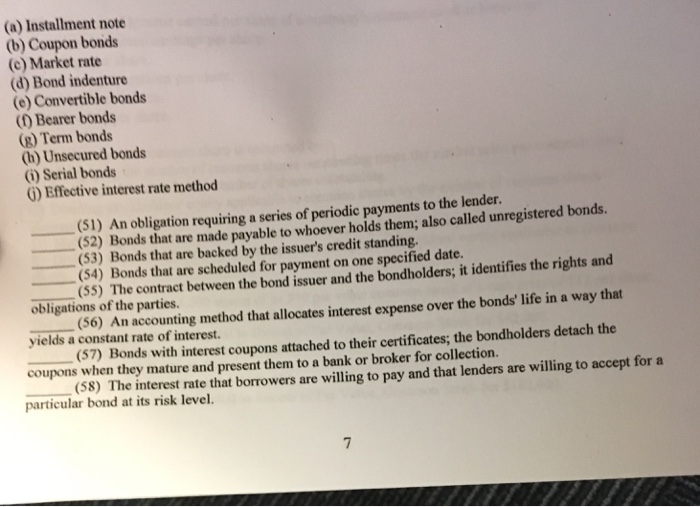

Question: (a) Installment note (b) Coupon bonds (c) Market rate (d) Bond indenture (e) Convertible bonds () Bearer bonds (g) Term bonds (h) Unsecured bonds (i)

(a) Installment note (b) Coupon bonds (c) Market rate (d) Bond indenture (e) Convertible bonds () Bearer bonds (g) Term bonds (h) Unsecured bonds (i) Serial bonds G) Effective interest rate method 1) An obligation requiring a series of periodic payments to the lender. (52) Bonds that are made (53) Bonds that are backed by the issuer's credit standing (S4) Bonds that are scheduled for payment on one specified date (5 s that are made payable to whoever holds them; also called unregistered bonds obligations of the parties. yields a constant rate of interest. coupons when they mature and present them to a bank or broker for collection. particular bond at its risk level. ) The contract between the bond issuer and the bondholders; it identifies the rights and (56) An accounting method that allocates interest expense over the bonds' life in a way that (57) Bonds with interest coupons attached to their certificates; the bondholders detach the (S8) The interest rate that borrowers are willing to pay and that lenders are willing to accept for a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts