Question: a) is just for information , it is question b) i want answers from For all of Part I, consider a financial market consisting of

a) is just for information, it is question b) i want answers from

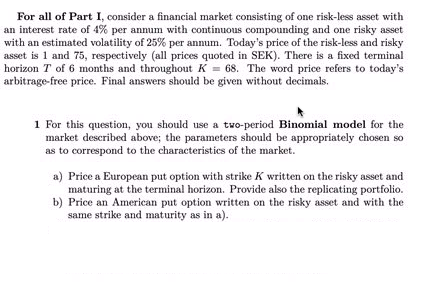

For all of Part I, consider a financial market consisting of one risk-less asset with an interest rate of 4% per annum with continuous compounding and one risky asset with an estimated volatility of 25% per annum. Today's price of the risk-less and risky asset is 1 and 75, respectively (all prices quoted in SEK). There is a fixed terminal horizon T of 6 months and throughout K = 68. The word price refers to today's arbitrage-free price. Final answers should be given without decimals, 1 For this question, you should use a tvo-period Binomial model for the market described above; the parameters should be appropriately chosen so as to correspond to the characteristics of the market. a) Price a European put option with strike K written on the risky asset and maturing at the terminal horizon. Provide also the replicating portfolio. b) Price an American put option written on the risky asset and with the same strike and maturity as in a). For all of Part I, consider a financial market consisting of one risk-less asset with an interest rate of 4% per annum with continuous compounding and one risky asset with an estimated volatility of 25% per annum. Today's price of the risk-less and risky asset is 1 and 75, respectively (all prices quoted in SEK). There is a fixed terminal horizon T of 6 months and throughout K = 68. The word price refers to today's arbitrage-free price. Final answers should be given without decimals, 1 For this question, you should use a tvo-period Binomial model for the market described above; the parameters should be appropriately chosen so as to correspond to the characteristics of the market. a) Price a European put option with strike K written on the risky asset and maturing at the terminal horizon. Provide also the replicating portfolio. b) Price an American put option written on the risky asset and with the same strike and maturity as in a)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts