Question: A is wrong Question 26 (1 point) Saved Carrie buys land from her mother for $50,000. The mother's cost basis in the land is $65,000.

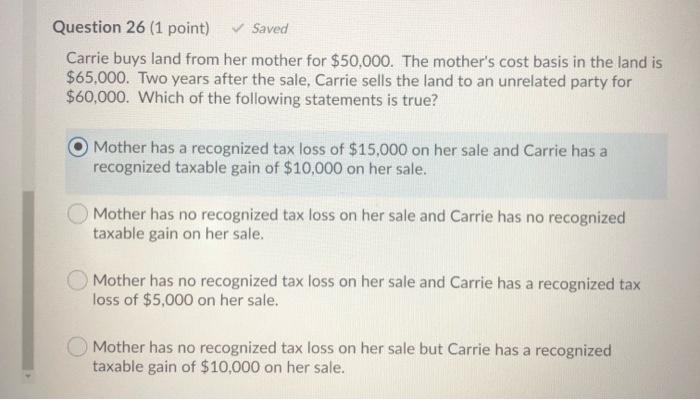

Question 26 (1 point) Saved Carrie buys land from her mother for $50,000. The mother's cost basis in the land is $65,000. Two years after the sale, Carrie sells the land to an unrelated party for $60,000. Which of the following statements is true? Mother has a recognized tax loss of $15,000 on her sale and Carrie has a recognized taxable gain of $10,000 on her sale. Mother has no recognized tax loss on her sale and Carrie has no recognized taxable gain on her sale. Mother has no recognized tax loss on her sale and Carrie has a recognized tax loss of $5,000 on her sale. Mother has no recognized tax loss on her sale but Carrie has a recognized taxable gain of $10,000 on her sale

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts