Question: (a)? J TIPMs, if at all? tHE US in recent months, how might this affect (10 marks) ons out of Questions 2-5 lif you answer

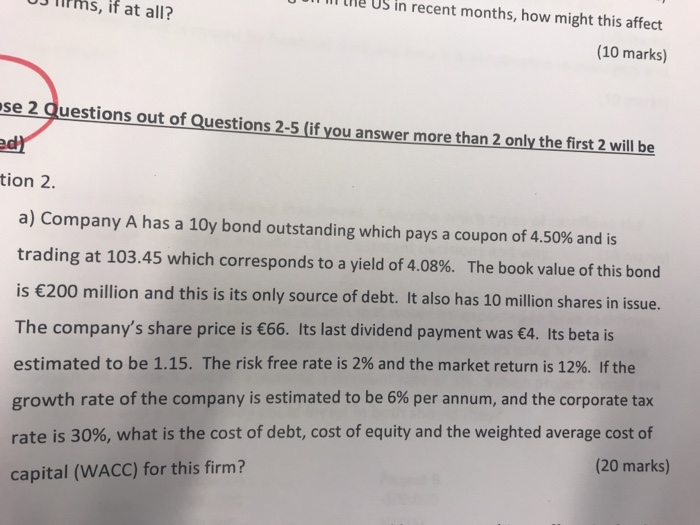

J TIPMs, if at all? tHE US in recent months, how might this affect (10 marks) ons out of Questions 2-5 lif you answer more than 2 only the first 2 will be tion 2. a) Company A has a 10y bond outstanding which pays a coupon of 4.50% and is trading at 103.45 which corresponds to a yield of 4.08%. The book value of this bond is 200 million and this is its only source of debt. It also has 10 millin shares in issue. The company's share price is 66. Its last dividend payment was 4. Its beta is estimated to be 1.15. The risk free rate is 2% and the market return is 12%. If the growth rate of the company is estimated to be 6% per annum, and the corporate tax rate is 30%, what is the cost of debt, cost of equity and the weighted average cost of capital (WACC) for this firm? (20 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts