Question: A . Jan owtas a smalt affice eamplex in Gilbert. She wishes to get but of the office trate and mowe into residential properties. Sho

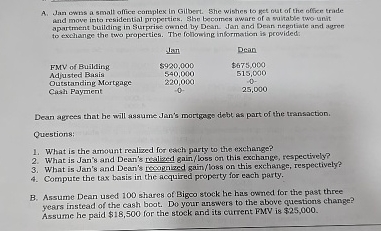

A Jan owtas a smalt affice eamplex in Gilbert. She wishes to get but of the office trate and mowe into residential properties. Sho bocomes aware of a sultable two unit apartment building in Surprise owned by Dean. Jon and Dean negotikte and agren to ewchange the two properties. The following information is provided:

tableJan,DeanFMV of Building.,$$Adjusted Basia,Outstanding Mortgage,tableCash Payment,

Dean agrees that he will assume Jan's mortgage debt as part of the transaction.

Questions:

What is the amount realized for each party to the exchange?

What is Jan's and Dean's realized gainloss on this exchange, respectively?

What is Jan's and Dean's tecagnized gainkoss on this exchange, respectively?

Compute the tax basis in the acquired property for each party.

B Assume Dean used shares of Bigco stock he has owned for the past three years instead of the cash boot. Do your answers to the above questions change? Assume he paid $ for the stock and its current FMV is $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock