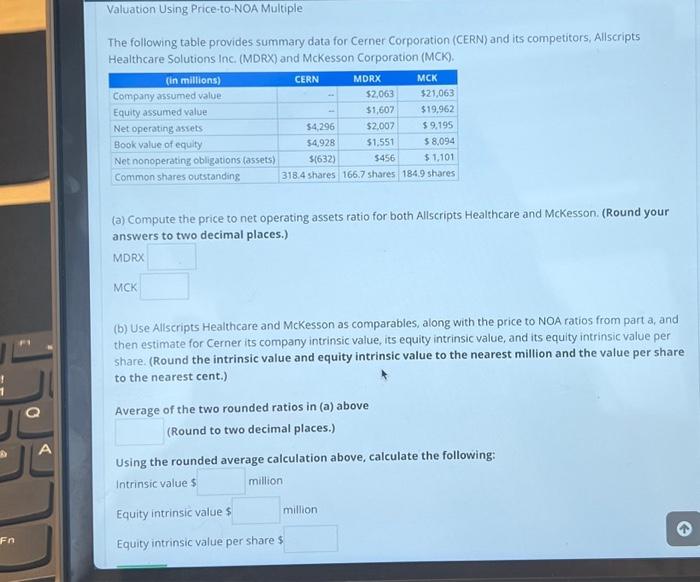

Question: A JE Fn Valuation Using Price-to-NOA Multiple The following table provides summary data for Cerner Corporation (CERN) and its competitors, Allscripts Healthcare Solutions Inc. (MDRX)

The following table provides summary data for Cerner Corporation (CERN) and its competitors, Allscripts Healthcare Solutions Inc. (MDRX) and McKesson Corporation (MCK). (a) Compute the price to net operating assets ratio for both Allscripts Healthcare and McKesson. (Round your answers to two decimal places.) MDRX MCK (b) Use Allscripts Healthcare and McKesson as comparables, along with the price to NOA ratios from part a, and then estimate for Cerner its company intrinsic value, its equity intrinsic value, and its equity intrinsic value per share. (Round the intrinsic value and equity intrinsic value to the nearest million and the value per share to the nearest cent.) Average of the two rounded ratios in (a) above (Round to two decimal places.) Using the rounded average calculation above, calculate the following: Intrinsic value $ Equity intrinsic value s Equity intrinsic value per share $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts