Question: a) Joseph Corporation is considering two (2) mutually exclusive projects with depreciable lives of five (5) years. The after-tax cash flows for projects S and

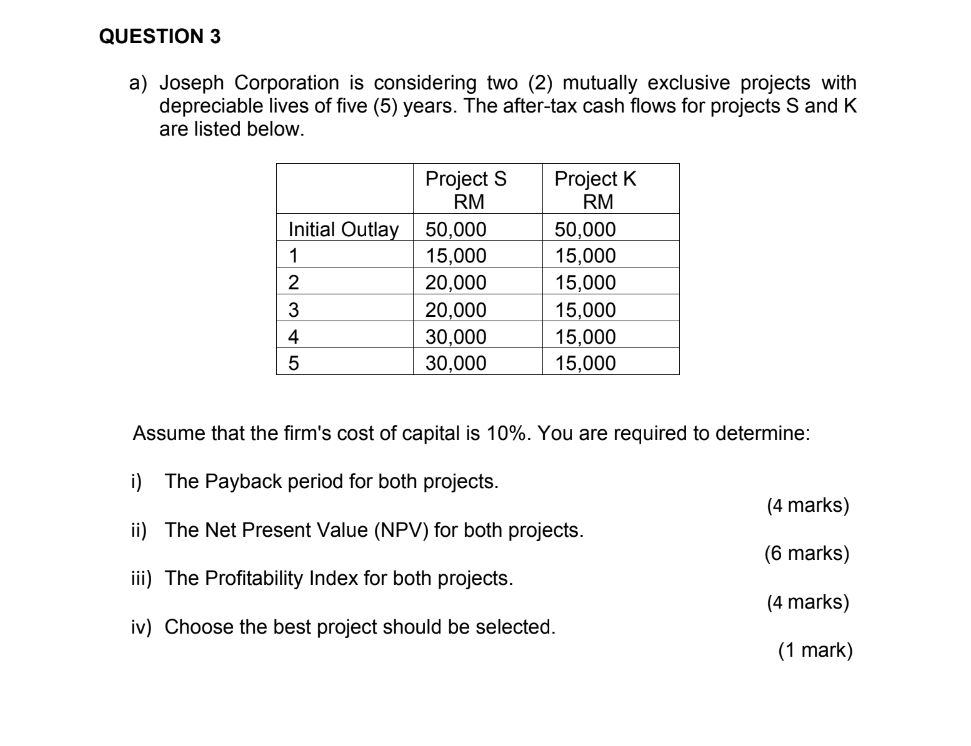

a) Joseph Corporation is considering two (2) mutually exclusive projects with depreciable lives of five (5) years. The after-tax cash flows for projects S and K are listed below. Assume that the firm's cost of capital is 10%. You are required to determine: i) The Payback period for both projects. ii) The Net Present Value (NPV) for both projects. (4 marks) iii) The Profitability Index for both projects. (6 marks) iv) Choose the best project should be selected. (4 marks) (1 mark) a) Joseph Corporation is considering two (2) mutually exclusive projects with depreciable lives of five (5) years. The after-tax cash flows for projects S and K are listed below. Assume that the firm's cost of capital is 10%. You are required to determine: i) The Payback period for both projects. ii) The Net Present Value (NPV) for both projects. (4 marks) iii) The Profitability Index for both projects. (6 marks) iv) Choose the best project should be selected. (4 marks) (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts