Question: a joumalize the transactions under the direct write-off method. b Joumalize the transactions under the allowance method, assuming that the allowance account had a beginning

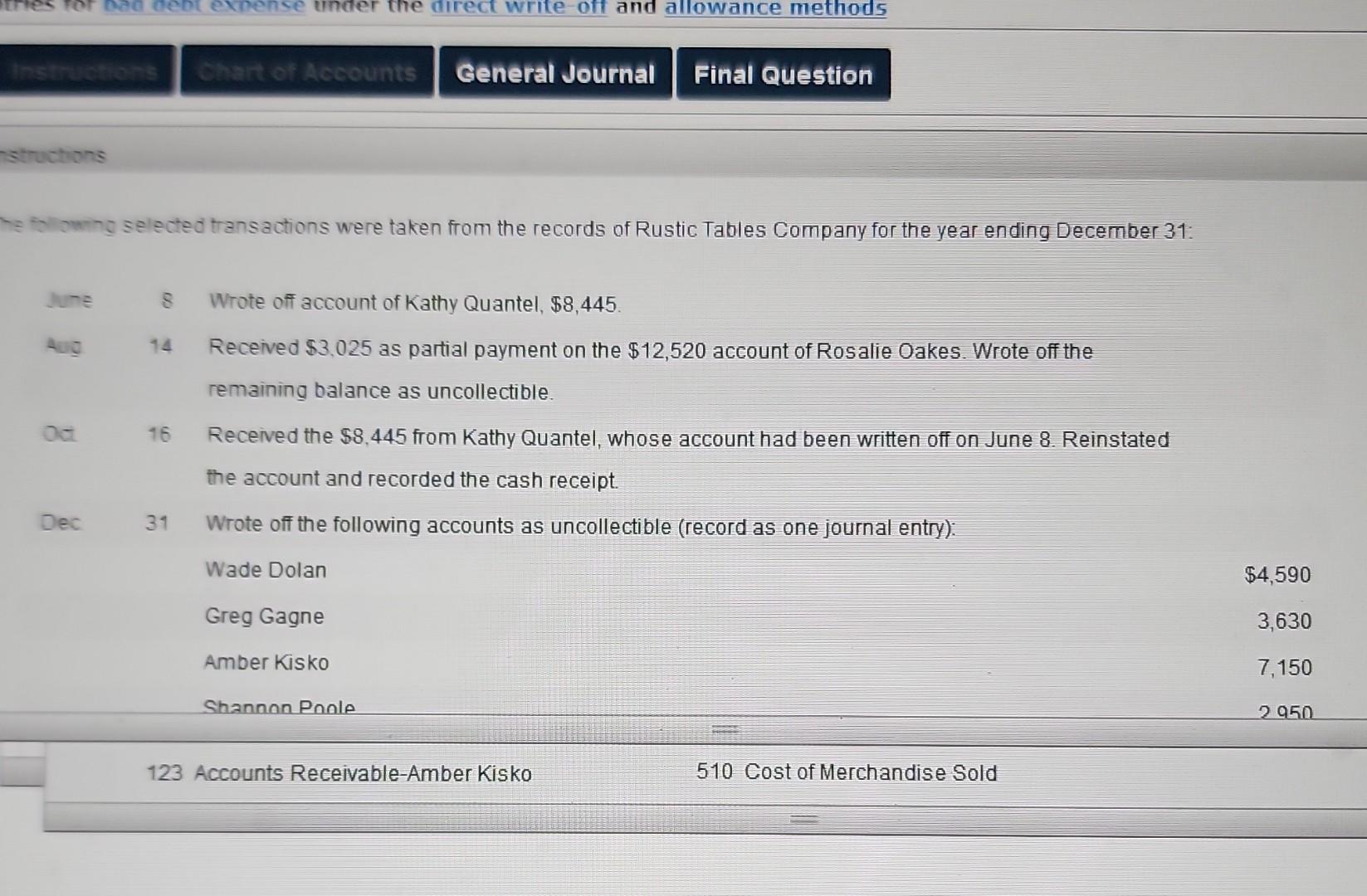

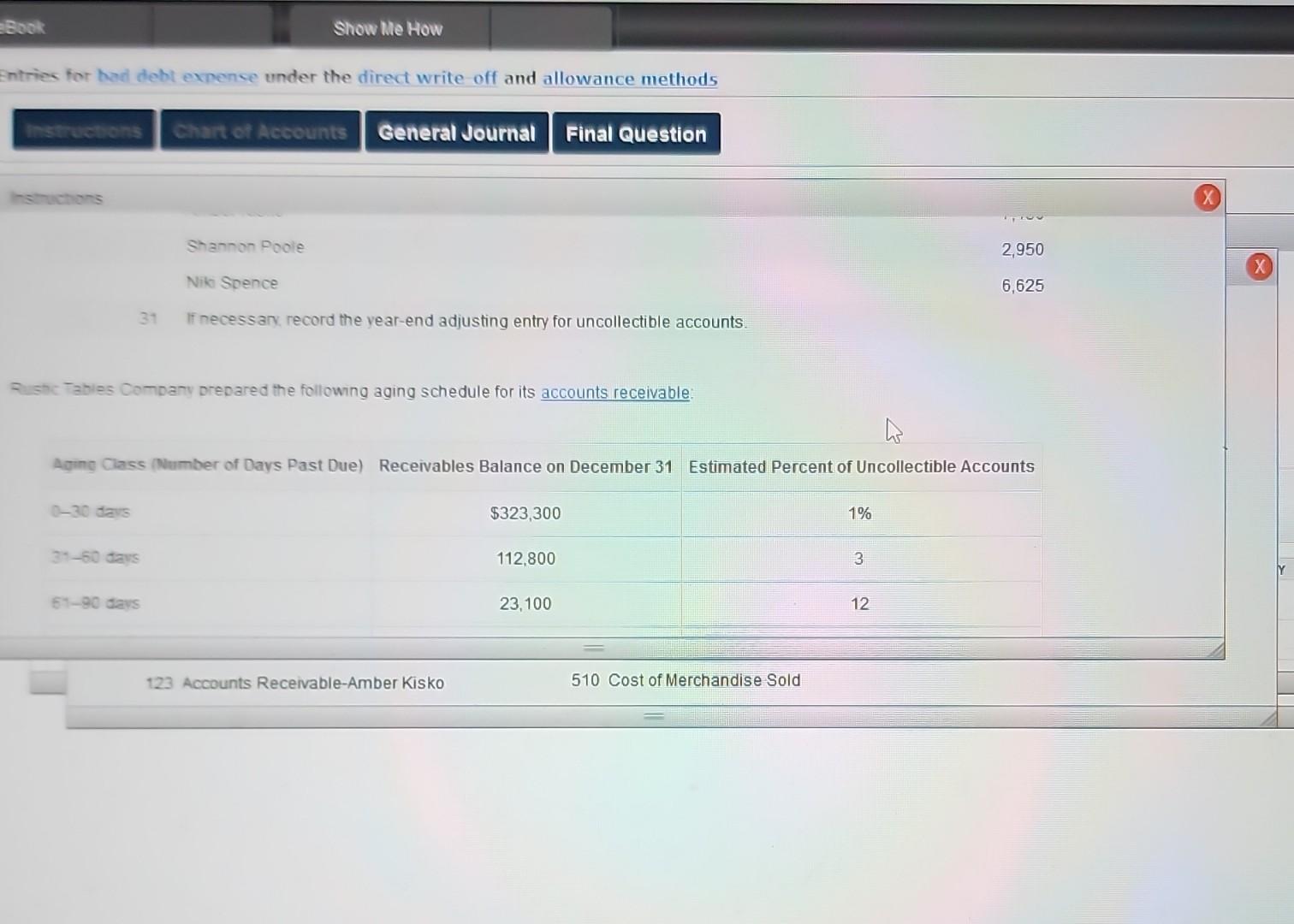

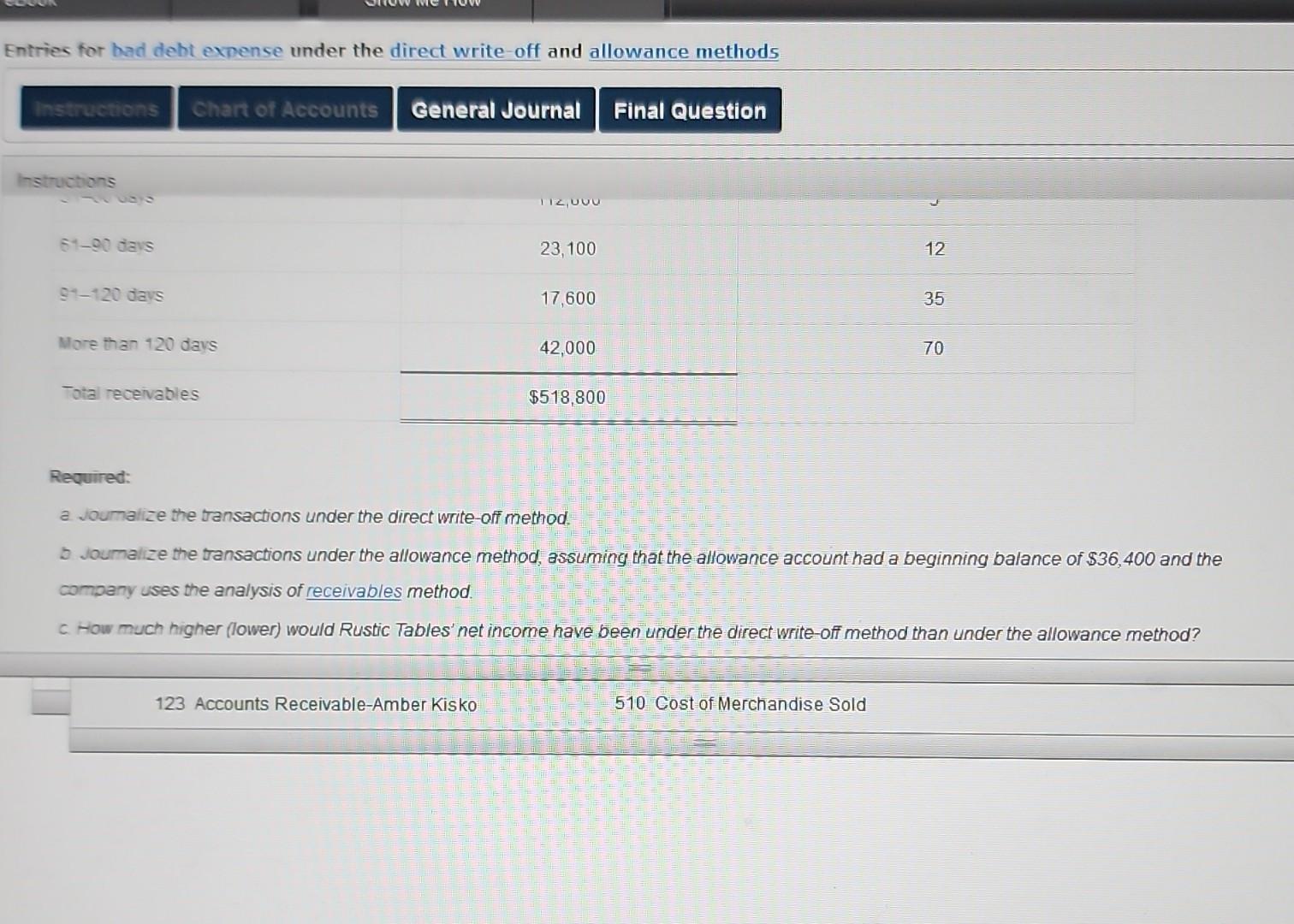

a joumalize the transactions under the direct write-off method. b Joumalize the transactions under the allowance method, assuming that the allowance account had a beginning balance of $36,400 and the company uses the analysis of receivables method. c. How much higher (lower) would Rustic Tables' net income have been under the direct write-off method than under the allowance method? Ristc- Tabies Company prepared the following aging schedule for its accounts receivable: General Journal Final Question selected transactions were taken from the records of Rustic Tables Company for the year ending December 31 : Whe Wrote off account of Kathy Quantel, $8,445. 14 Received $3,025 as partial payment on the $12,520 account of Rosalie Oakes. Wrote off the remaining balance as uncollectible. Oct. 16 Received the $8,445 from Kathy Quantel, whose account had been written off on June 8 . Reinstated the account and recorded the cash receipt. Dec 31 Wrote off the following accounts as uncollectible (record as one journal entry): Wade Dolan Greg Gagne Amber Kisko $4,590 Shannon Ponle 3,630 7,150 2950 123 Accounts Receivable-Amber Kisko 510 Cost of Merchandise Sold c tow much higher (lower) would Rustic Tables' net income have been under the direct write-off method than under the allowance m a joumalize the transactions under the direct write-off method. b Joumalize the transactions under the allowance method, assuming that the allowance account had a beginning balance of $36,400 and the company uses the analysis of receivables method. c. How much higher (lower) would Rustic Tables' net income have been under the direct write-off method than under the allowance method? Ristc- Tabies Company prepared the following aging schedule for its accounts receivable: General Journal Final Question selected transactions were taken from the records of Rustic Tables Company for the year ending December 31 : Whe Wrote off account of Kathy Quantel, $8,445. 14 Received $3,025 as partial payment on the $12,520 account of Rosalie Oakes. Wrote off the remaining balance as uncollectible. Oct. 16 Received the $8,445 from Kathy Quantel, whose account had been written off on June 8 . Reinstated the account and recorded the cash receipt. Dec 31 Wrote off the following accounts as uncollectible (record as one journal entry): Wade Dolan Greg Gagne Amber Kisko $4,590 Shannon Ponle 3,630 7,150 2950 123 Accounts Receivable-Amber Kisko 510 Cost of Merchandise Sold c tow much higher (lower) would Rustic Tables' net income have been under the direct write-off method than under the allowance m

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts