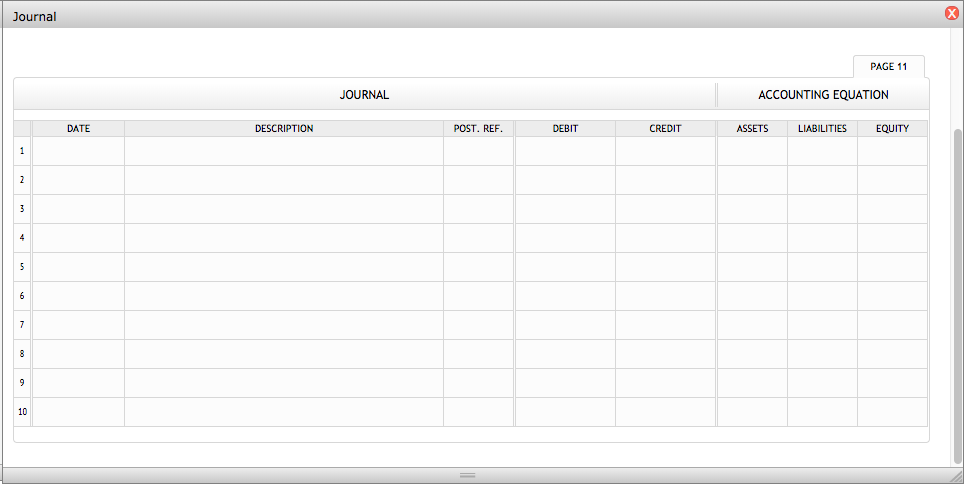

Question: a. Journalize the entry to record the payroll for the week of June 17.* b. Journalize the entry to record the payroll tax expense incurred

a. Journalize the entry to record the payroll for the week of June 17.*b. Journalize the entry to record the payroll tax expense incurred for the week of June 17.*

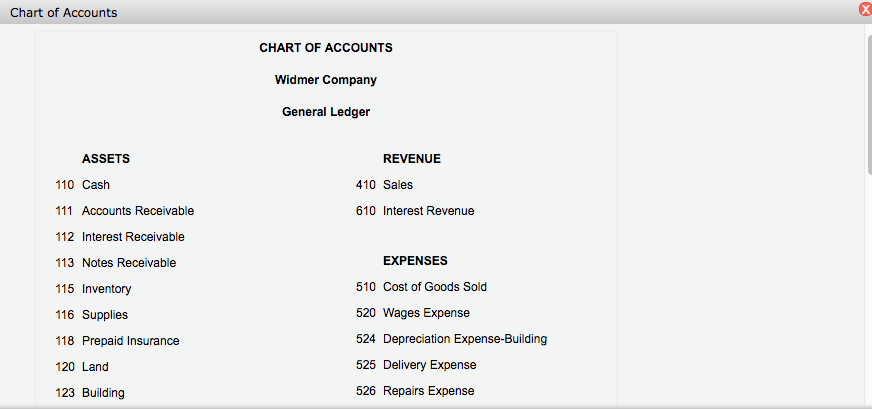

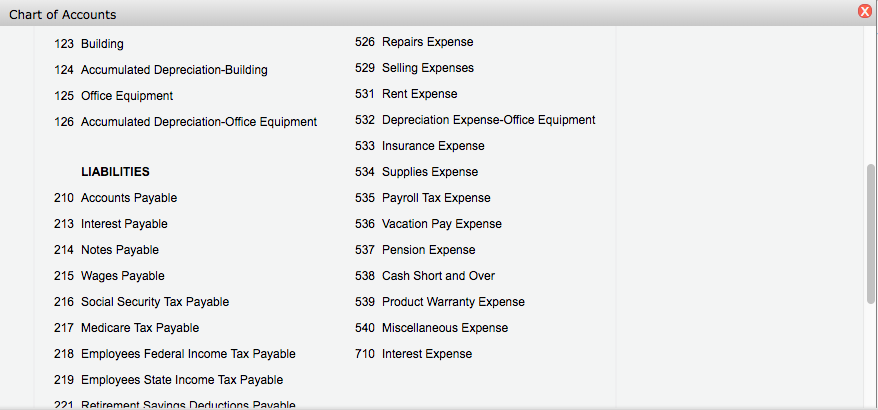

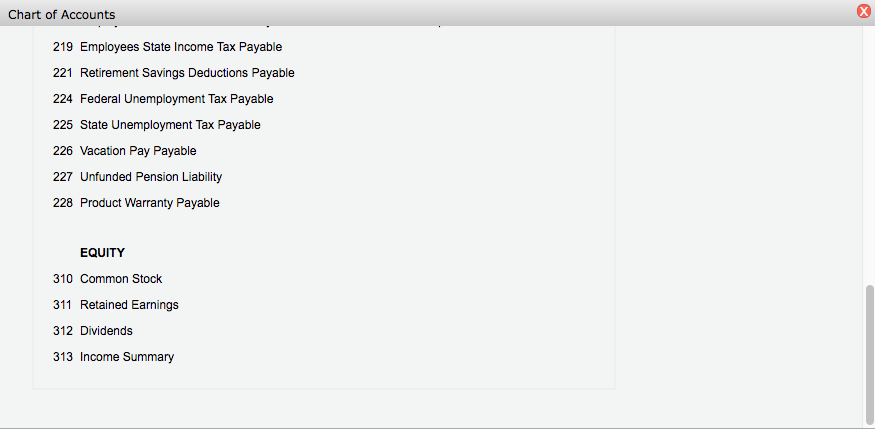

| * Refer to the Chart of Accounts for exact wording of account titles.

|

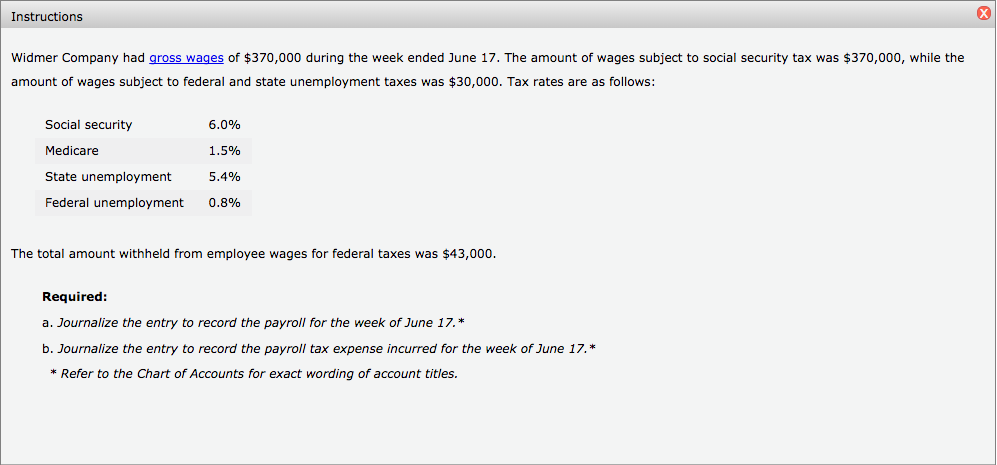

Instructions Widmer Company had gross wages of $370,000 during the week ended June 17. The amount of wages subject to social security tax was $370,000, while the amount of wages subject to federal and state unemployment taxes was $30,000. Tax rates are as follows: Social security Medicare State unemployment Federal unemployment 6.0% 1.5% 5.4% 0.8% The total amount withheld from employee wages for federal taxes was $43,000. Required: a. Journalize the entry to record the payroll for the week of June 17.* b. Journalize the entry to record the payroll tax expense incurred for the week of June 17.* * Refer to the Chart of Accounts for exact wording of account titles

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts