Question: a . Journalize the write - offs under the direct write - off method. If an amount box does not require an entry, leave it

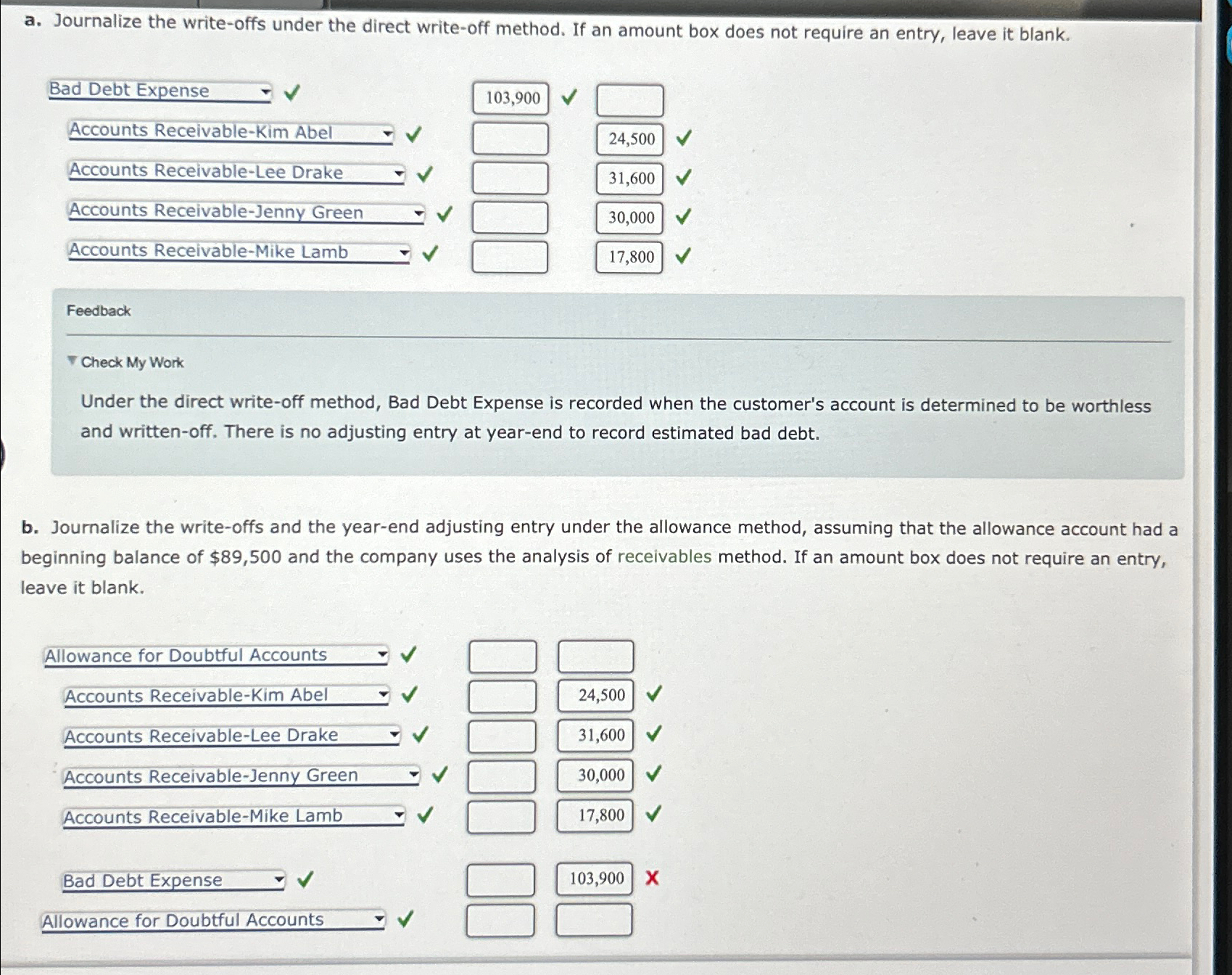

a Journalize the writeoffs under the direct writeoff method. If an amount box does not require an entry, leave it blank.

Bad Debt Expense

Accounts ReceivableJenny Green

Accounts ReceivableMike Lamb

Feedback

Check My Work

Under the direct writeoff method, Bad Debt Expense is recorded when the customer's account is determined to be worthless and writtenoff. There is no adjusting entry at yearend to record estimated bad debt.

b Journalize the writeoffs and the yearend adjusting entry under the allowance method, assuming that the allowance account had a beginning balance of $ and the company uses the analysis of receivables method. If an amount box does not require an entry, leave it blank.

Accounts ReceivableLee Drake

Accounts ReceivableMike Lamb

Allowance for Doubtful Accounts

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock