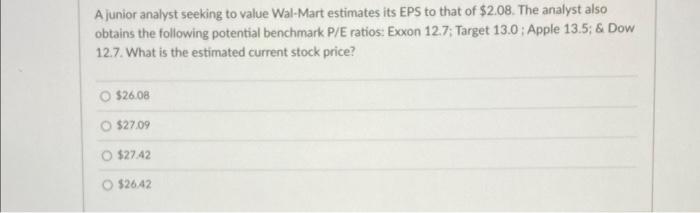

Question: A junior analyst seeking to value Wal-Mart estimates its EPS to that of $2.08. The analyst also obtains the following potential benchmark P/E ratios: Exxon

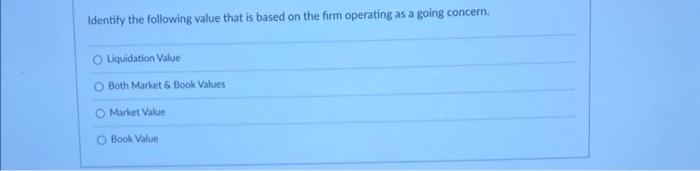

A junior analyst seeking to value Wal-Mart estimates its EPS to that of $2.08. The analyst also obtains the following potential benchmark P/E ratios: Exxon 127; Target 13.0 : Apple 13.5; & Dow 12.7. What is the estimated current stock price? $26.08 O $27.09 O $27.42 $26.42 42 An investor believes a company is likely to make a very profitable investments in the future, therefore, the investor is willing to pay more for the company's stock today, Identify the following value that is based on the firm operating as a going concern. O Liquidation Value Both Market & Book Values Market Value Book Value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts