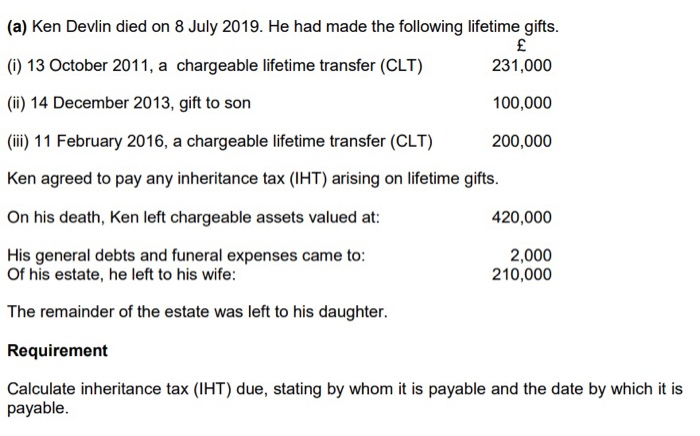

Question: (a) Ken Devlin died on 8 July 2019. He had made the following lifetime gifts. (1) 13 October 2011, a chargeable lifetime transfer (CLT) 231,000

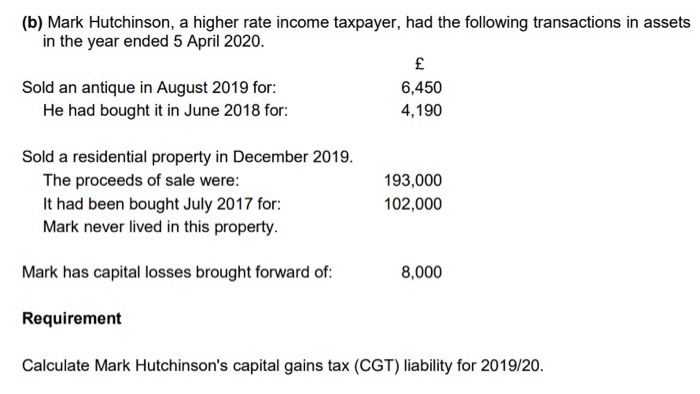

(a) Ken Devlin died on 8 July 2019. He had made the following lifetime gifts. (1) 13 October 2011, a chargeable lifetime transfer (CLT) 231,000 (ii) 14 December 2013, gift to son 100,000 (iii) 11 February 2016, a chargeable lifetime transfer (CLT) 200,000 Ken agreed to pay any inheritance tax (IHT) arising on lifetime gifts. On his death, Ken left chargeable assets valued at: 420,000 His general debts and funeral expenses came to: 2,000 Of his estate, he left to his wife: 210,000 The remainder of the estate was left to his daughter. Requirement Calculate inheritance tax (IHT) due, stating by whom it is payable and the date by which it is payable. (b) Mark Hutchinson, a higher rate income taxpayer, had the following transactions in assets in the year ended 5 April 2020. Sold an antique in August 2019 for: 6,450 He had bought it in June 2018 for: 4,190 Sold a residential property in December 2019. The proceeds of sale were: It had been bought July 2017 for: Mark never lived in this property. 193,000 102,000 Mark has capital losses brought forward of: 8,000 Requirement Calculate Mark Hutchinson's capital gains tax (CGT) liability for 2019/20. (a) Ken Devlin died on 8 July 2019. He had made the following lifetime gifts. (1) 13 October 2011, a chargeable lifetime transfer (CLT) 231,000 (ii) 14 December 2013, gift to son 100,000 (iii) 11 February 2016, a chargeable lifetime transfer (CLT) 200,000 Ken agreed to pay any inheritance tax (IHT) arising on lifetime gifts. On his death, Ken left chargeable assets valued at: 420,000 His general debts and funeral expenses came to: 2,000 Of his estate, he left to his wife: 210,000 The remainder of the estate was left to his daughter. Requirement Calculate inheritance tax (IHT) due, stating by whom it is payable and the date by which it is payable. (b) Mark Hutchinson, a higher rate income taxpayer, had the following transactions in assets in the year ended 5 April 2020. Sold an antique in August 2019 for: 6,450 He had bought it in June 2018 for: 4,190 Sold a residential property in December 2019. The proceeds of sale were: It had been bought July 2017 for: Mark never lived in this property. 193,000 102,000 Mark has capital losses brought forward of: 8,000 Requirement Calculate Mark Hutchinson's capital gains tax (CGT) liability for 2019/20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts