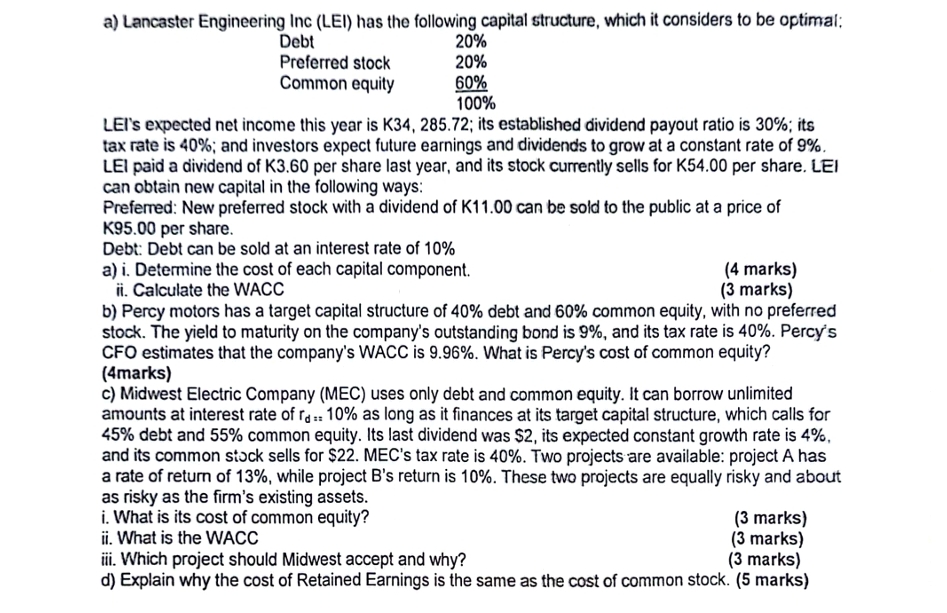

Question: a ) Lancaster Engineering Inc ( LEI ) has the following capital structure, which it considers to be optimal: Debt Preferred stock Common equity 2

a Lancaster Engineering Inc LEI has the following capital structure, which it considers to be optimal:

Debt

Preferred stock

Common equity

LEI's expected net income this year is K; its established dividend payout ratio is ; its tax rate is ; and investors expect future earnings and dividends to grow at a constant rate of LEI paid a dividend of K per share last year, and its stock currently sells for K per share. LEI

can obtain new capital in the following ways: Preferred: New preferred stock with a dividend of K can be sold to the public at a price of K per share.

Debt: Debt can be sold at an interest rate of

a i Determine the cost of each capital component.

ii Calculate the WACC

marks

marks

b Percy motors has a target capital structure of debt and common equity, with no preferred stock. The yield to maturity on the company's outstanding bond is and its tax rate is Percy's CFO estimates that the company's WACC is What is Percy's cost of common equity?

marks

c Midwest Electric Company MEC uses only debt and common equity. It can borrow unlimited amounts at interest rate of ra as long as it finances at its target capital structure, which calls for debt and common equity. Its last dividend was $ its expected constant growth rate is and its common stock sells for $ MEC's tax rate is Two projects are available: project A has a rate of return of while project Bs retum is These two projects are equally risky and about

as risky as the firm's existing assets. i What is its cost of common equity?

marks

ii What is the WACC

marks

iii. Which project should Midwest accept and why?

marks

d Explain why the cost of Retained Earnings is the same as the cost of common stock. marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock