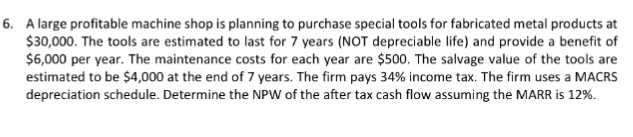

Question: A large profitable machine shop is planning to purchase special tools for fabricated metal products at $30,000. The tools are estimated to last for 7

A large profitable machine shop is planning to purchase special tools for fabricated metal products at $30,000. The tools are estimated to last for 7 years (NOT depreciable life) and provide a benefit of $6,000 per year. The maintenance costs for each year are $500. The salvage value of the tools are estimated to be $4,000 at the end of 7 years. The firm pays 34% income tax. The firm uses a MACRS depreciation schedule. Determine the NPW of the after tax cash flow assuming the MARR is 12%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts