Question: A large utility company is considering two mutually exclusive methods for storing its coal combustion by-products. One method is wet (slurry) storage and the second

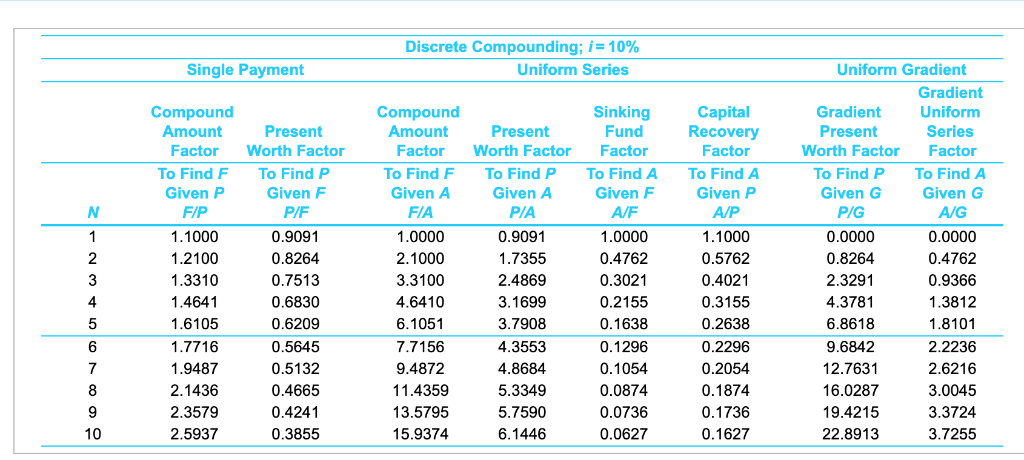

A large utility company is considering two mutually exclusive methods for storing its coal combustion by-products. One method is wet (slurry) storage and the second method is dry storage. The company must adopt one of those two methods for all 28 of its ash and gypsum impoundments at seven coal-fired power plants. Wet storage requires an initial investment of $2 billion, followed by annual maintenance expenses of $300 million over a 10-year period of time. Dry storage has a $2.5 billion capital investment and $150 million per year upkeep expenses over its 7-year life. If the company's MARR is 10% per year, which method should be recommended assuming repeatability? Click the icon to view the interest and annuity table for discrete compounding when the MARR is 10% per year. The equivalent uniform annual cost for the wet storage is million. (Round to one decimal place.) Discrete Compounding: i-10% Single Payment Uniform Series Uniform Gradient Gradient Sinking Fund Factor To Find A Given F A/F 1.0000 0.4762 0.3021 0.2155 0.1638 0.1296 Compound Amount Compound Amount Factor To Find F Given A Capital Recovery Factor To Find A Given P A/P 1.1000 0.5762 0.4021 0.3155 0.2638 0.2296 0.2054 0.1874 0.1736 0.1627 Uniformm Series Worth Factor Factor Gradient Present Present Present Worth Factor To Find P Given A Factor Worth Factor To Find F Given F To FindP Given F To Find P Given G To FindA Given 0.9091 0.8264 0.7513 0.6830 0.6209 0.5645 0.5132 0.4665 0.4241 0.3855 1.0000 2.1000 3.3100 4.6410 6.1051 7.7156 9.4872 11.4359 13.5795 15.9374 0.0000 0.8264 2.3291 4.3781 6.8618 9.6842 12.7631 16.0287 19.4215 22.8913 A/G 0.0000 0.4762 0.9366 1.3812 1.8101 2.2236 2.6216 3.0045 3.3724 3.7255 1.1000 1.2100 1.3310 1.4641 1.6105 0.9091 1.7355 2.4869 3.1699 3.7908 4.3553 4.8684 5.3349 5.7590 6.1446 2 4 1.9487 2.1436 2.3579 2.5937 0.0874 0.0736 0.0627

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts