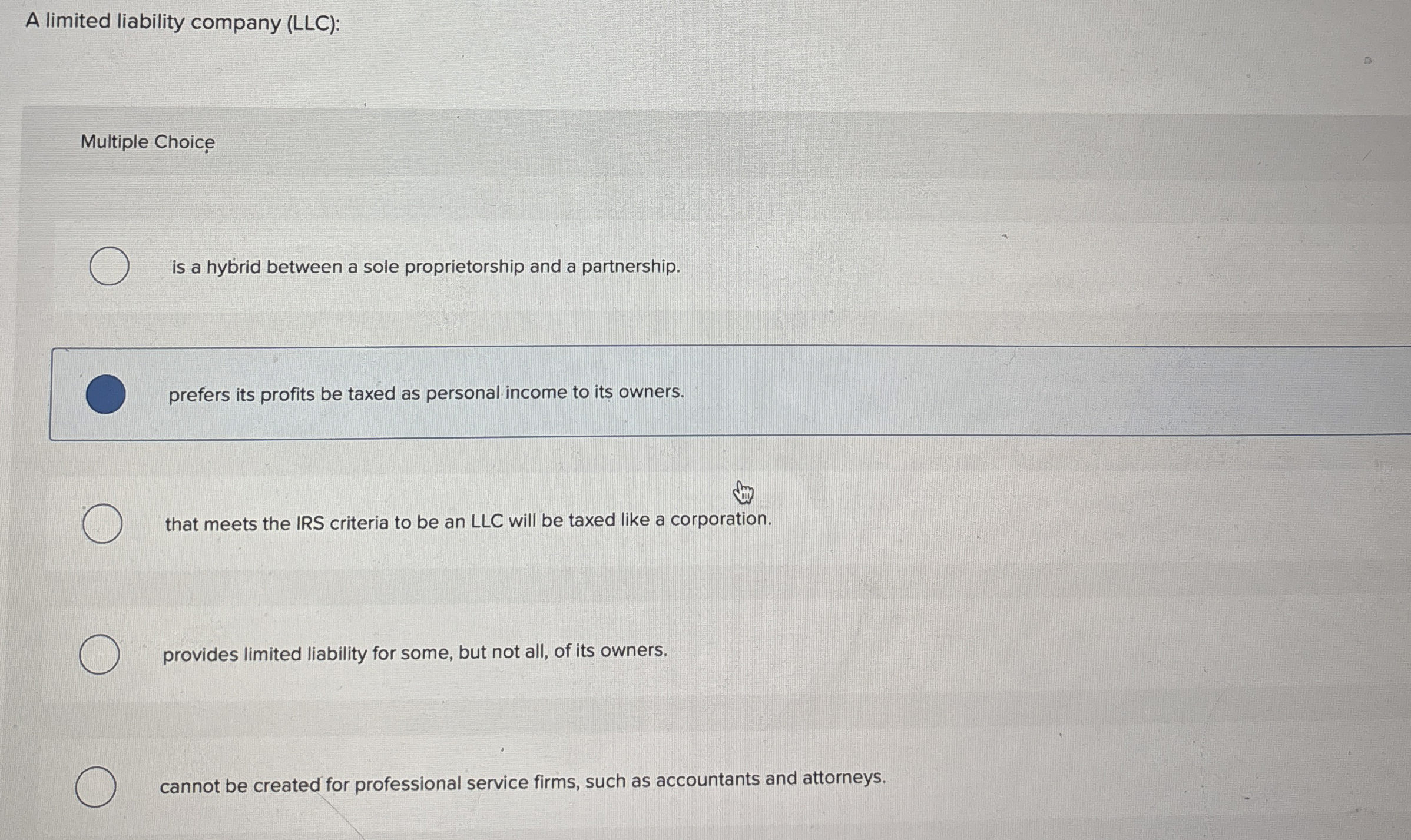

Question: A limited liability company ( LLC ) : Multiple Choice is a hybrid between a sole proprietorship and a partnership. prefers its profits be taxed

A limited liability company LLC:

Multiple Choice

is a hybrid between a sole proprietorship and a partnership.

prefers its profits be taxed as personal income to its owners.

that meets the IRS criteria to be an LLC will be taxed like a corporation.

provides limited liability for some, but not all, of its owners.

cannot be created for professional service firms, such as accountants and attorneys.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock