Question: A limited partnership ( LP ) was formed between two general partners who contributed $ 1 0 0 , 0 0 0 in capital and

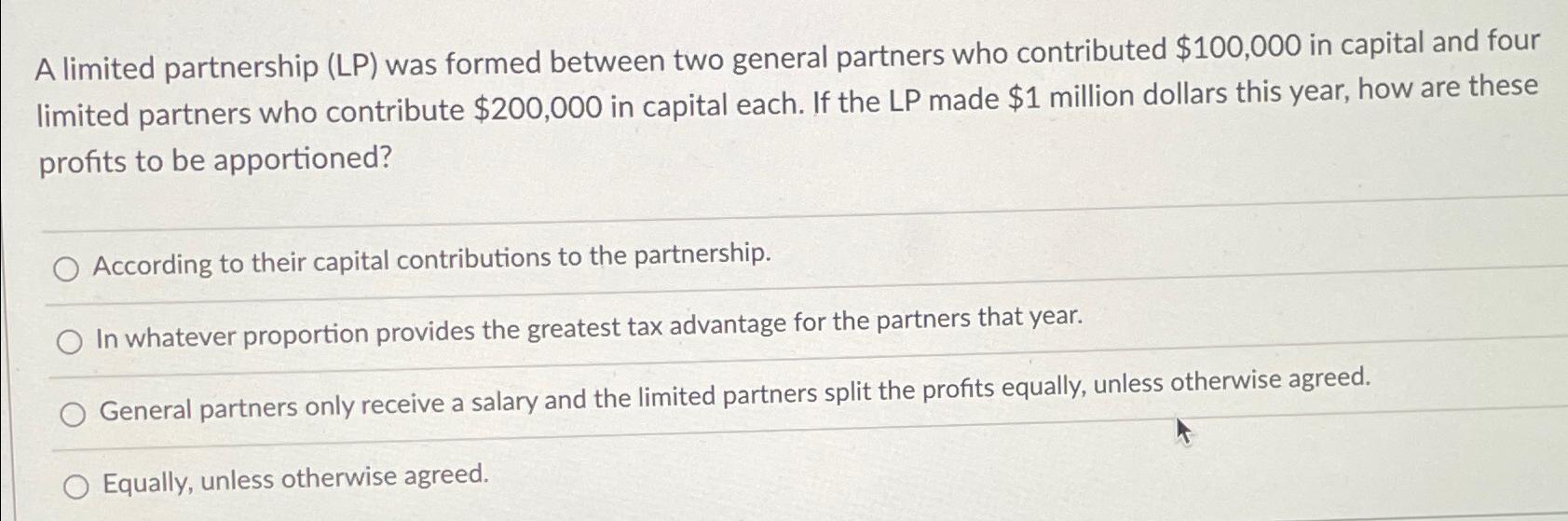

A limited partnership LP was formed between two general partners who contributed $ in capital and four limited partners who contribute $ in capital each. If the LP made $ million dollars this year, how are these profits to be apportioned?

According to their capital contributions to the partnership.

In whatever proportion provides the greatest tax advantage for the partners that year.

General partners only receive a salary and the limited partners split the profits equally, unless otherwise agreed.

Equally, unless otherwise agreed.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock