Question: A load serving entity predicts tomorrow's spot electricity price with the following posibilities 5% change the price is $50/MWh 15% chance the price is

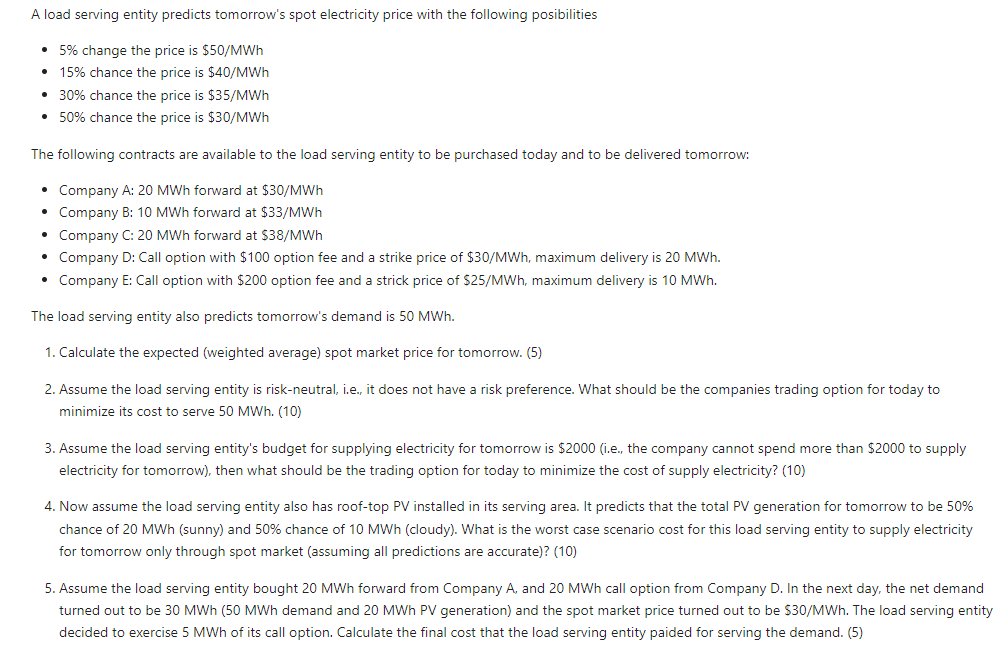

A load serving entity predicts tomorrow's spot electricity price with the following posibilities 5% change the price is $50/MWh 15% chance the price is $40/MWh 30% chance the price is $35/MWh 50% chance the price is $30/MWh The following contracts are available to the load serving entity to be purchased today and to be delivered tomorrow: Company A: 20 MWh forward at $30/MWh Company B: 10 MWh forward at $33/MWh Company C: 20 MWh forward at $38/MWh Company D: Call option with $100 option fee and a strike price of $30/MWh, maximum delivery is 20 MWh. Company E: Call option with $200 option fee and a strick price of $25/MWh, maximum delivery is 10 MWh. The load serving entity also predicts tomorrow's demand is 50 MWh. 1. Calculate the expected (weighted average) spot market price for tomorrow. (5) 2. Assume the load serving entity is risk-neutral, i.e., it does not have a risk preference. What should be the companies trading option for today to minimize its cost to serve 50 MWh. (10) 3. Assume the load serving entity's budget for supplying electricity for tomorrow is $2000 (i.e., the company cannot spend more than $2000 to supply electricity for tomorrow), then what should be the trading option for today to minimize the cost of supply electricity? (10) 4. Now assume the load serving entity also has roof-top PV installed in its serving area. It predicts that the total PV generation for tomorrow to be 50% chance of 20 MWh (sunny) and 50% chance of 10 MWh (cloudy). What is the worst case scenario cost for this load serving entity to supply electricity for tomorrow only through spot market (assuming all predictions are accurate)? (10) 5. Assume the load serving entity bought 20 MWh forward from Company A, and 20 MWh call option from Company D. In the next day, the net demand turned out to be 30 MWh (50 MWh demand and 20 MWh PV generation) and the spot market price turned out to be $30/MWh. The load serving entity decided to exercise 5 MWh of its call option. Calculate the final cost that the load serving entity paided for serving the demand. (5)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts