Question: A local software company's current income statement is shown below. The company has planned an aggressive sales growth rate of 20% for next year (Fiscal

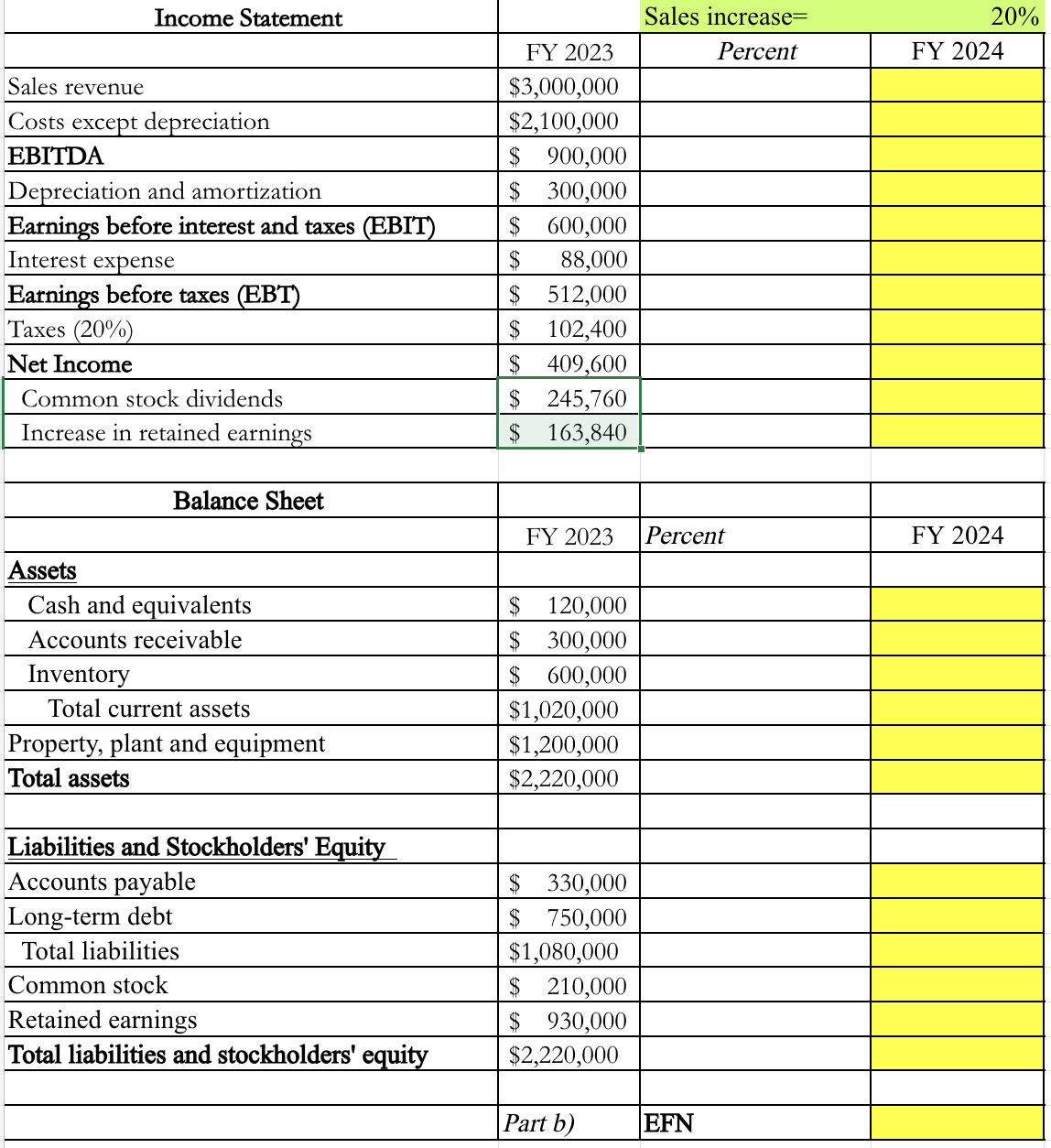

A local software company's current income statement is shown below. The company has planned an aggressive sales growth rate of 20% for next year (Fiscal Year 2024), and they are currently unsure how to finance this expansion.Practically, this means that when constructing the 2024 statements, entries connected with long term debt and equity will be equal to the 2023 levels, and that the pro-forma balance sheet will not necessarily balance.Q21A. Please use the percentage-of-sales approach (and the excel template below) to constructi. The firm's pro-forma income statement for next year (Fiscal Year 2024) (2 points)ii. The firm's pro-forma balance sheet for next year (Fiscal Year 2024) (2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts