Question: A logistics executive for a large global consumer durable goods company hosted a supply chain management advisory board. During dinner at a local restaurant, the

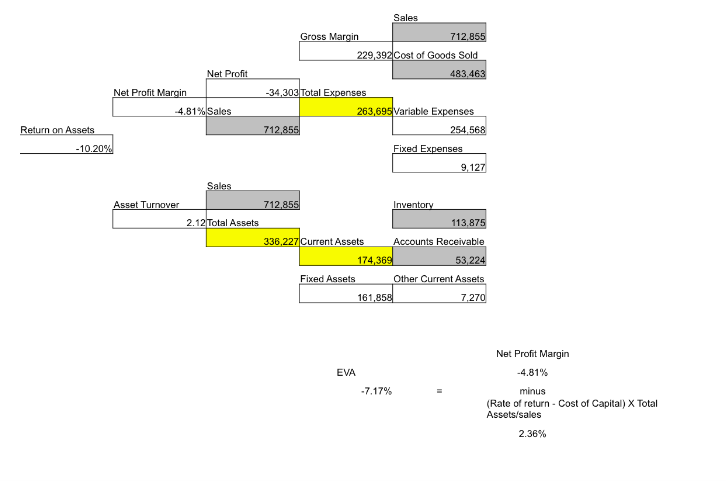

A logistics executive for a large global consumer durable goods company hosted a supply chain management advisory board. During dinner at a local restaurant, the executive leading this group noticed another group from their firm with a group of visitors in another private room in the restaurant. It turned out this other group consisted of the companys purchasing executives hosting their own supply chain management advisory board. Neither group, to their collective surprise and chagrin, had any knowledge that the other group was meeting, nor what they were talking about. As both sides thought about it, they realized that it was symptomatic of a purchasing group making decisions about purchasing locations globally with no insight into costs of movement. At the same time, the logistics group was focused on how to reduce costs of global warehousing, inventory and transportation with no insights into future locations of supply and manufacturing. The ideal plan-source-make-deliver model morphed into a new disconnected reality. Over time, the overall performance of the firm suffered significantly as competition from both domestic and international firms has cut into market share and undercut pricing, reducing profit margins and impacting broader financial metrics such as ROA, average inventory, inventory turns, etc. Some key financial results for the most recent fiscal year are shown in the Strategic Profit Model below.

Ultimately, these financial struggles caused a turnover in senior leadership, including the firing of the CEO and replacement with a new CEO and leadership team, many of whom have spent their careers in the automotive industry. The new CEO has promised a rapid turnaround in performance to the financial markets, including a return to profitability with a positive ROA by the end of year 1. While some improvement is expected from new product innovations, she has clearly expressed her intention to leverage the supply chain to deliver much of this financial improvement. The CEO has hired a new Chief Supply Chain Officer to help leverage optimal value out of the supply chain. The CSCO has been given a mandate from the leadership team to take a relatively free hand in restructuring the internal supply chain organization to improve performance and deliver immediate financial results. The CSCO, a member of the Global Supply Chain Advisory Board, has commissioned your team to conduct an audit of existing conditions and suggest initiatives to help drive immediate change through the supply chain organization. Given your vast expertise in supply chain strategy after having now spent

2.5 weeks in a core course on Introduction to Supply Chain Management, your task is to

develop solutions to the following tasks:

1) Identify 3 major initiatives that the CSCO should pursue in year 1 to achieve the

performance goals mandated by the CEO. Provide some detail (for supply chain

managers with at least 2.5 weeks of classroom knowledge of SCM!!) regarding the

specific operational activities included in each of these initiatives.

2) Present a best/worst/most likely case scenario of total financial impact of these

initiatives using the Strategic Profit Model.

Sales Return on Assets - 10.20% Gross Margin 712.855 229,392 Cost of Goods Sold Net Profit 483.463 Net Profit Margin -34,303 Total Expenses 4.81% Sales 263,695 Variable Expenses 712,855 254,568 Fixed Expenses 9,127 Sales Asset Turnover 712.855 Inventory 2.12 Total Assets 113,875 336,227 Current Assets Accounts Receivable 174,369 53,224 Fixed Assets Other Current Assets 161,858 7.270 Net Profit Margin -4.81% EVA -7.17% minus (Rate of return - Cost of Capital) X Total Assets/sales 2.36%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts