Question: A long - term construction project was started in Year 1 and completed in Year 2 . Revenue is recognized over time according to percentage

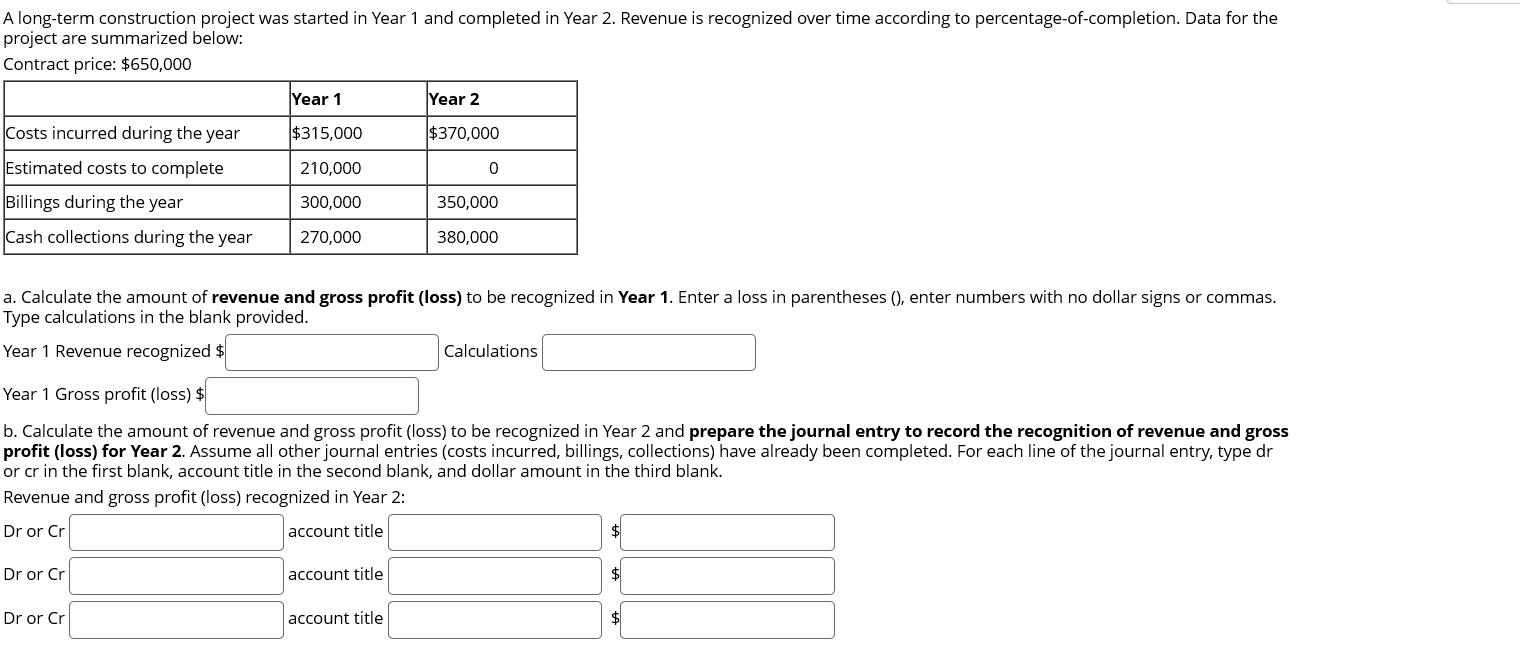

A longterm construction project was started in Year and completed in Year Revenue is recognized over time according to percentageofcompletion. Data for the project are summarized below: Contract price: $ a Calculate the amount of revenue and gross profit loss to be recognized in Year Enter a loss in parentheses enter numbers with no dollar signs or commas. Type calculations in the blank provided. Year Revenue recognized $ Calculations Year Gross profit loss$ b Calculate the amount of revenue and gross profit loss to be recognized in Year and prepare the journal entry to record the recognition of revenue and gross profit loss for Year Assume all other journal entries costs incurred, billings, collections have already been completed. For each line of the journal entry, type dr or cr in the first blank, account title in the second blank, and dollar amount in the third blank. Revenue and gross profit loss recognized in Year :

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock