Question: (a) Luigi the Supporter Ltd. uses an automated process to clean and polish souvenir items. For March, the company had the following activities: 15

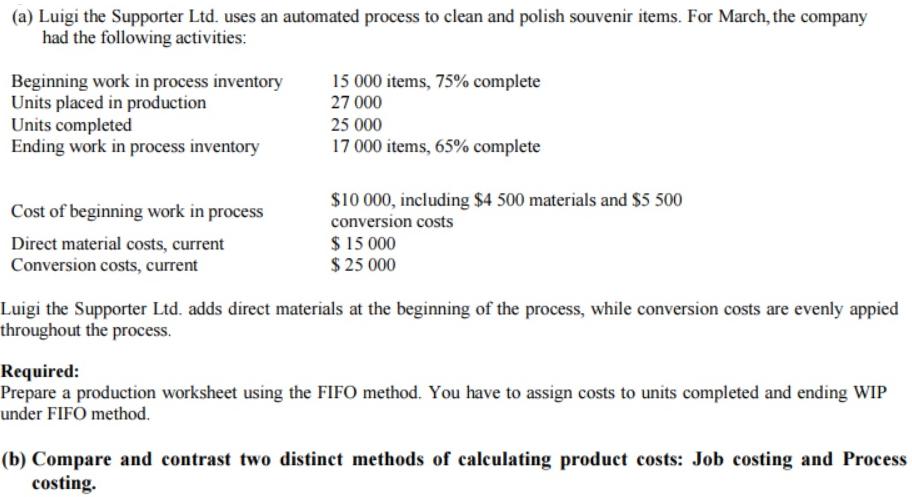

(a) Luigi the Supporter Ltd. uses an automated process to clean and polish souvenir items. For March, the company had the following activities: 15 000 items, 75% complete 27 000 Beginning work in process inventory Units placed in production Units completed Ending work in process inventory 25 000 17 000 items, 65% complete $10 000, including $4 500 materials and $5 500 Cost of beginning work in process conversion costs $ 15 000 $ 25 000 Direct material costs, current Conversion costs, current Luigi the Supporter Ltd. adds direct materials at the beginning of the process, while conversion costs are evenly appied throughout the process. Required: Prepare a production worksheet using the FIFO method. You have to assign costs to units completed and ending WIP under FIFO method. (b) Compare and contrast two distinct methods of calculating product costs: Job costing and Process costing.

Step by Step Solution

3.49 Rating (159 Votes )

There are 3 Steps involved in it

To solve this problem well first set up the production worksheet using the FIFO method and then compare job costing and process costing a Production W... View full answer

Get step-by-step solutions from verified subject matter experts