Question: a M Inbox (2) - billiegui... Fit3D Visualize a H... Apple G Google >> Other boo Amazon.com: Onlin... 2020 New Acct 116A Spring on campus

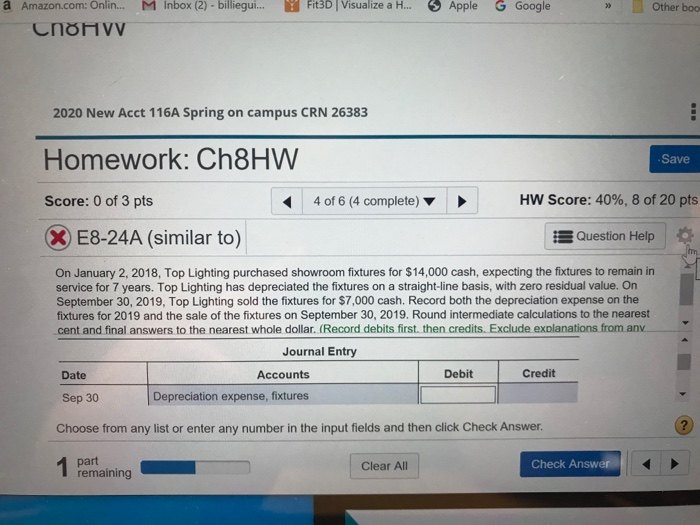

a M Inbox (2) - billiegui... Fit3D Visualize a H... Apple G Google >> Other boo Amazon.com: Onlin... 2020 New Acct 116A Spring on campus CRN 26383 Homework: Ch8HW Save Score: 0 of 3 pts 4 of 6 (4 complete) HW Score: 40%, 8 of 20 pts X E8-24A (similar to) Question Help On January 2, 2018, Top Lighting purchased showroom fixtures for $14,000 cash, expecting the fixtures to remain in service for 7 years. Top Lighting has depreciated the fixtures on a straight-line basis, with zero residual value. On September 30, 2019, Top Lighting sold the fixtures for $7,000 cash. Record both the depreciation expense on the fixtures for 2019 and the sale of the fixtures on September 30, 2019. Round Intermediate calculations to the nearest cent and final answers to the nearest whole dollar. (Record debits first, then credits. Exclude explanations from any Journal Entry Date Accounts Debit Credit Sep 30 Depreciation expense, fixtures Choose from any list or enter any number in the input fields and then click Check Answer. part remaining Clear All Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts