Question: A machine costing $ 2 5 7 , 5 0 0 with a four - year life and an estimated $ 2 0 , 0

A machine costing $ with a fouryear life and an estimated $ salvage value is installed in Luther Company's factory on January The factory manager estimates the machine will produce units of product during its life. It actually produces the following units: in Year in Year in Year and in Year The total number of units produced by the end of Year exceeds the original estimatethis difference was not predicted. Note: The machine cannot be depreciated below its estimated salvage value.

Required:

Compute depreciation for each year and total depreciation of all years combined for the machine under each depreciation method.

Note: Round your per unit depreciation to decimal places.

Complete this question by entering your answers in the tabs below.

Straight Line

Units of

Double Production declining balance

Compute depreciation for each year and total depreciation of all years combined for the machine under the Straightline depreciation.

tableStraightLine DepreciationYeartableDepreciationExpenseYear Year Year Year Total

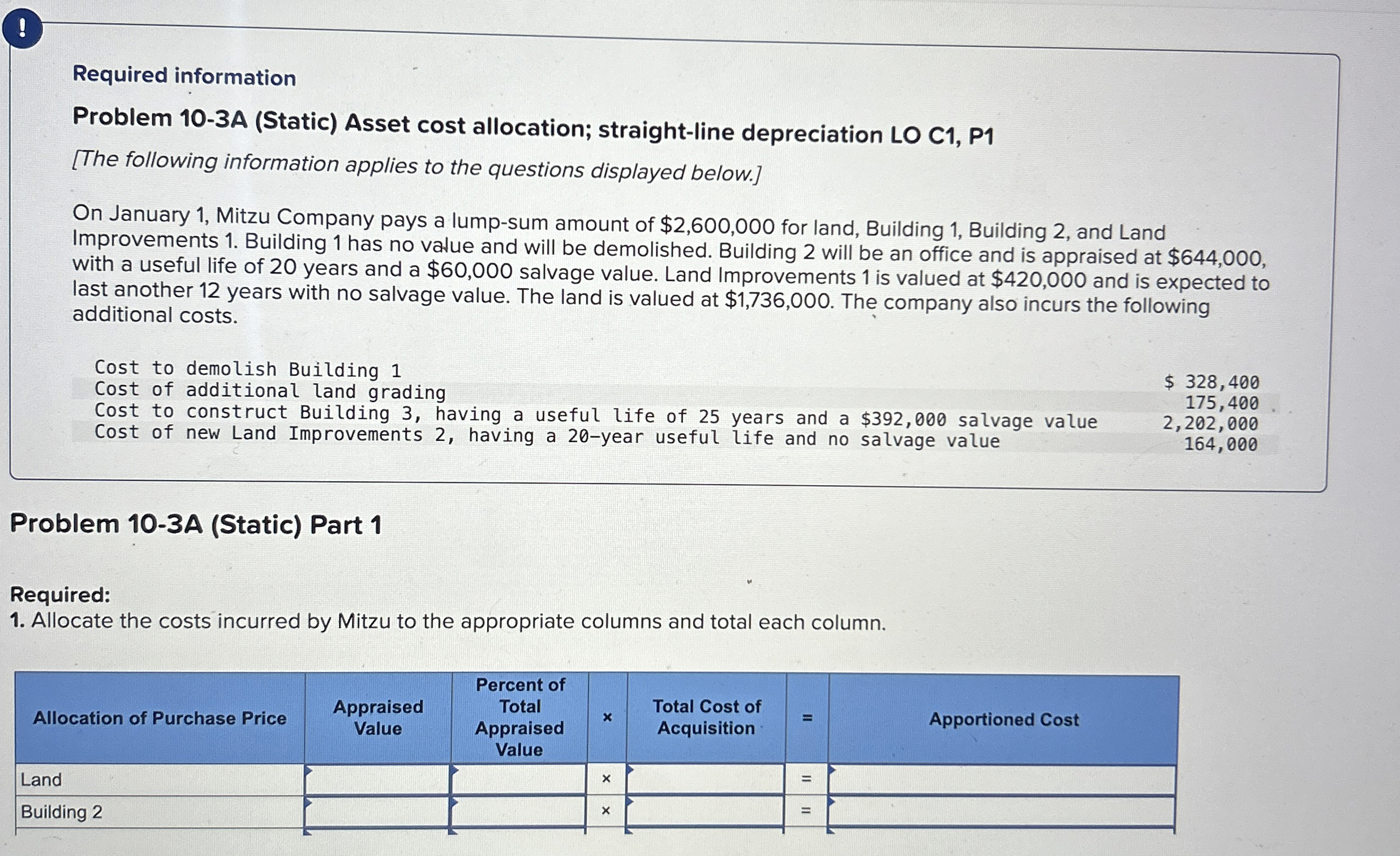

Required information

Problem A Static Asset cost allocation; straightline depreciation LO C P

The following information applies to the questions displayed below.

On January Mitzu Company pays a lumpsum amount of $ for land, Building Building and Land Improvements Building has no value and will be demolished. Building will be an office and is appraised at $ with a useful life of years and a $ salvage value. Land Improvements is valued at $ and is expected to last another years with no salvage value. The land is valued at $ The company also incurs the following additional costs.

Cost to demolish Building

Cost of additional land grading

Cost to construct Building having a useful life of years and a $ salvage value

Cost of new Land Improvements having a year useful life and no salvage value

$

Problem A Static Part

Required:

Allocate the costs incurred by Mitzu to the appropriate columns and total each column.

tableAllocation of Purchase Price,tableAppraisedValuetablePercent ofTotalAppraisedValuetableTotal Cost ofAcquisition

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock