Question: A machine that costs $5,600 is expected to operate for 7 years. The estimated salvage value at the end of 7 years is $0. The

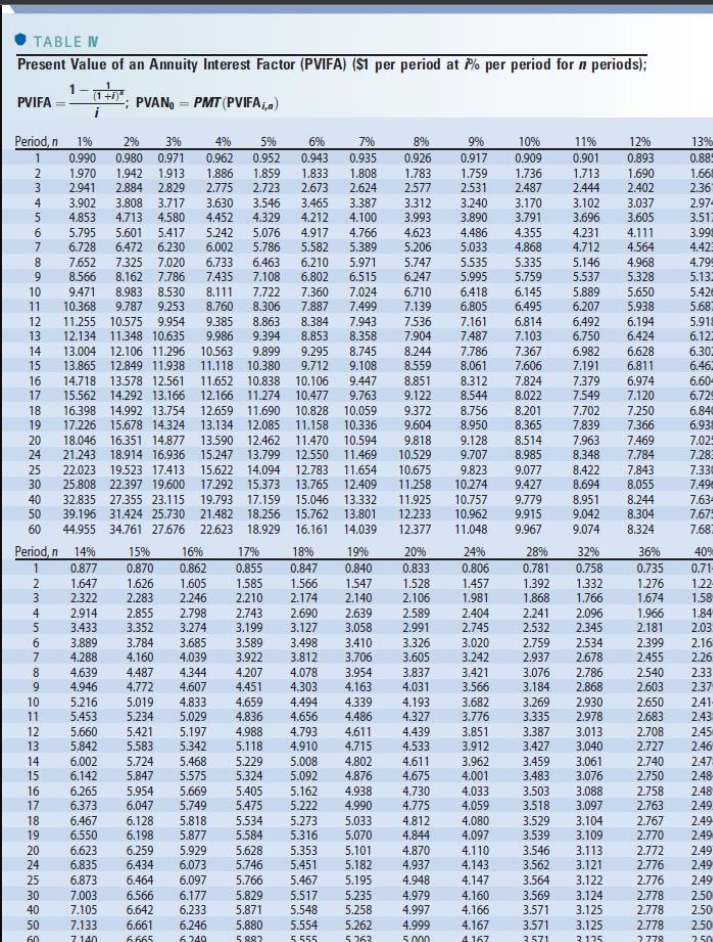

A machine that costs $5,600 is expected to operate for 7 years. The estimated salvage value at the end of 7 years is $0. The machine is expected to save the company $1,463 per year before taxes and depreciation. The company depreciates its assets on a straight-line basis and has a marginal tax rate of 40 percent. What is the exact internal rate of return on this investment? Use the calculator and Table IV to answer the question. Round your answer to two decimal places.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock