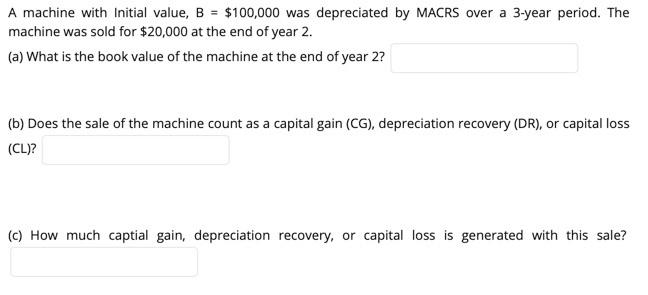

Question: A machine with Initial value, B = $100,000 was depreciated by MACRS Over a 3-year period. The machine was sold for $20,000 at the end

A machine with Initial value, B = $100,000 was depreciated by MACRS Over a 3-year period. The machine was sold for $20,000 at the end of year 2. (a) What is the book value of the machine at the end of year 2? (b) Does the sale of the machine count as a capital gain (CG), depreciation recovery (DR), or capital loss (CL)? (c) How much captial gain, depreciation recovery, or capital loss is generated with this sale

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts