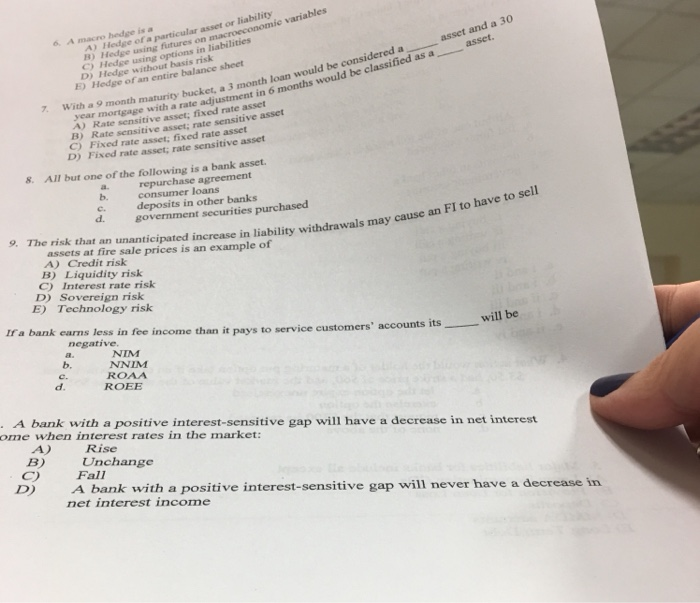

Question: &. A macro hedge is a nic variables A) Hedge of a particular asset or liability asset and a 30 asset ) Hedge using futures

&. A macro hedge is a nic variables A) Hedge of a particular asset or liability asset and a 30 asset ) Hedge using futures on macroeconom C) Hedge using options in liabilities would be considered a 6 months would be classified as a D) Hedge without basis risk E) Hedge of an entire balance sheet 7 With with a rate adjustment in ve asset; fixed rate asset a 9 month maturity bucket, a 3 month loan year mortgage A) Rate sensiti B) Rate sensitive asset; rate sensitive asset C) Fixed rate asset; fixed rate asset D) Fixed rate asset; rate sensitive asset All but one of the following is a bank asset. 8. a. b. repurchase agreement consumer loans deposits in other banks government securities purchased c. d. FI to have to sell assetshat an ianticipated increase in liability withdrawals may cause an assets at fire sale prices is an example of A) Credit risk B) Liquidity risk C) Interest rate risk D) Sovereign risk E) Technology risk Ira bank earns less in fee income than it pays to service customers negative ' accounts its will be NIM NNIM ROAA b. d. ROEE , A bank with a positive interest-sensitive gap will have a decrease in net interest ome when interest rates in the market: A) B) Unchange Rise C Fall D) A bank with a positive interest-sensitive gap will never have a decrease in net intcrest income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts