Question: A major requirement in managing a fixed income portfolio using a contingent immunization policy is monitoring the relationship between the current market value of the

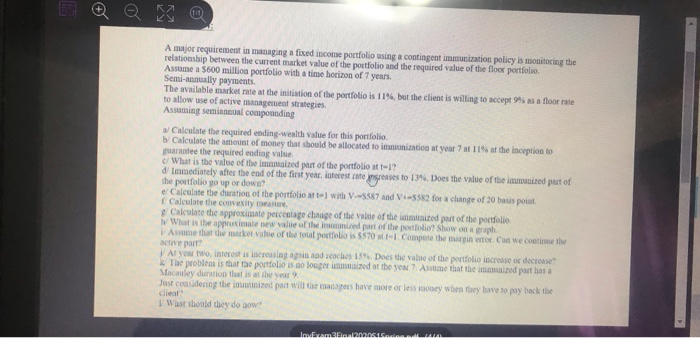

A major requirement in managing a fixed income portfolio using a contingent immunization policy is monitoring the relationship between the current market value of the portfolio and the required value of the floor portfolio Assume a $600 million portfolio with a time horizon of 7 years Semi-annually payments The available market rate at the initiation of the portfolio is 11%, but the client is willing to accept as a floor rate to allow use of active management strategies Assuming semiannual compounding Calculate the required ending-wealth value for this portfolio Calculate the amount of money that should be allocated to initization at year 7 at 11% at the inception to guarantee the required ending value What is the value of the imamized part of the portfolio attul? Immediately after the end of the first your interest rate grosses to 1. Does the value of the immunized part of the portfolio go up or down? e Calculate the duration of the portfolio aft) with V.5587 and V-5582 for a change of 20 basis point Calculate the convexity measure Calculate the approximate percentage change of the value of the immunited put of the portfolio What is the approximate new value of the monized part of the portfolio Show on a graph. Assume that the market value of the total portfolio is $570 - Compute the margin error Can we continue the active part Al you two interest is increasing again and reaches 15 Does the value of the portfolio increase or decrease The problem is that the portfolio is no longer immed at the year 7. Assume that the immunized port has a Macabey duration that is at the year Just considering the imatized part will the managers have more or less money when they have to pay back the client 1 What should they do now Imam 312000 w A major requirement in managing a fixed income portfolio using a contingent immunization policy is monitoring the relationship between the current market value of the portfolio and the required value of the floor portfolio Assume a $600 million portfolio with a time horizon of 7 years Semi-annually payments The available market rate at the initiation of the portfolio is 11%, but the client is willing to accept as a floor rate to allow use of active management strategies Assuming semiannual compounding Calculate the required ending-wealth value for this portfolio Calculate the amount of money that should be allocated to initization at year 7 at 11% at the inception to guarantee the required ending value What is the value of the imamized part of the portfolio attul? Immediately after the end of the first your interest rate grosses to 1. Does the value of the immunized part of the portfolio go up or down? e Calculate the duration of the portfolio aft) with V.5587 and V-5582 for a change of 20 basis point Calculate the convexity measure Calculate the approximate percentage change of the value of the immunited put of the portfolio What is the approximate new value of the monized part of the portfolio Show on a graph. Assume that the market value of the total portfolio is $570 - Compute the margin error Can we continue the active part Al you two interest is increasing again and reaches 15 Does the value of the portfolio increase or decrease The problem is that the portfolio is no longer immed at the year 7. Assume that the immunized port has a Macabey duration that is at the year Just considering the imatized part will the managers have more or less money when they have to pay back the client 1 What should they do now Imam 312000 w

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts