Question: A manager is trying to decide whether to buy one machine or two. If only one machine is purchased and the demand proves to be

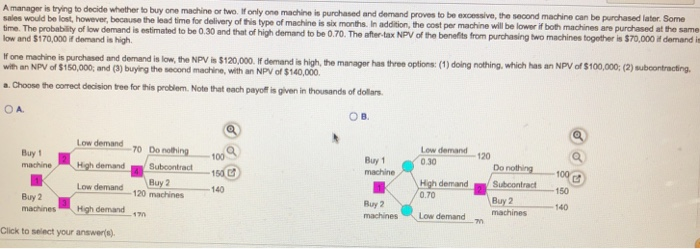

A manager is trying to decide whether to buy one machine or two. If only one machine is purchased and the demand proves to be excessive, the second machine can be purchased later. Some sales would be lost, however, because the lead time for delivery of this type of machine is six months. In addition, the cost per machine will be lower if both machines are purchased at the same time. The probability of low demand is estimated to be 0.30 in that of the high demand to be 0.70. The after tax in NPV of the benefits from purchasing two machines together is $70,000 if demand is low and $170,000 if demand is high.

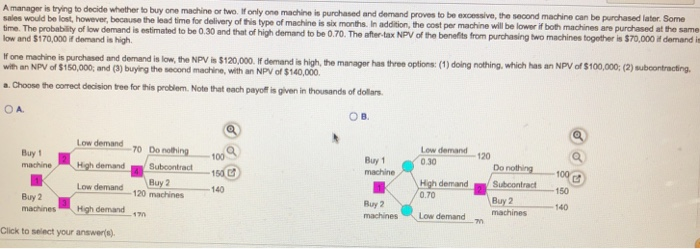

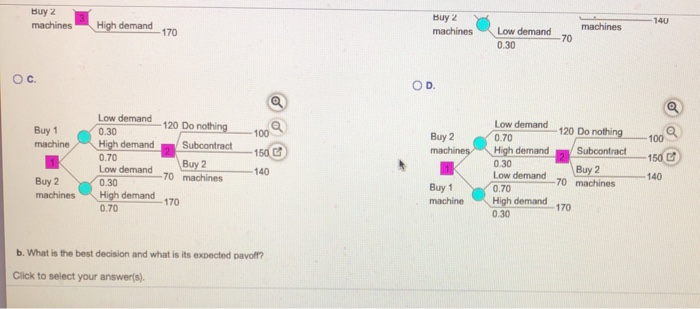

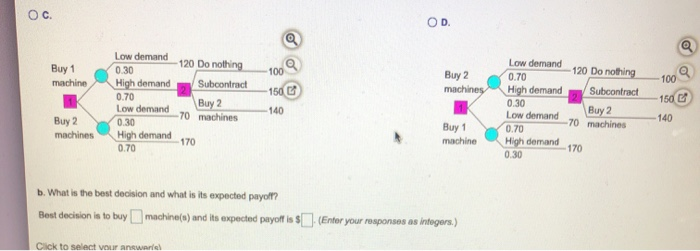

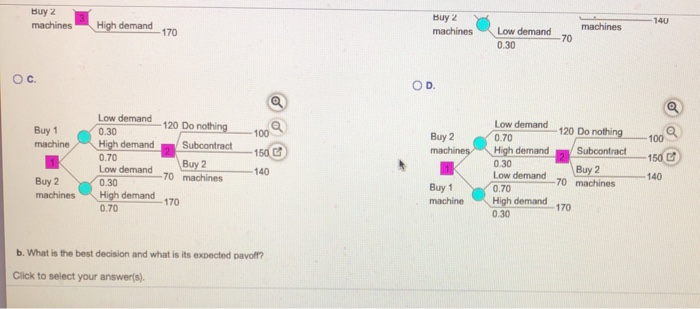

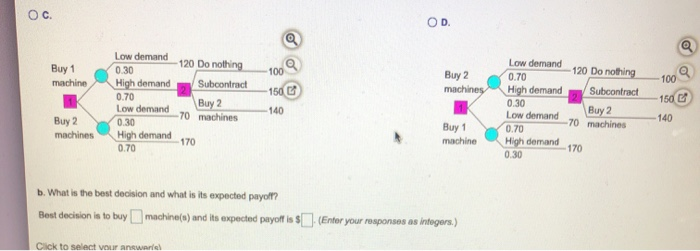

A manager is trying to decide whether to buy one machine or two. I only one machine is purchased and demand proves to be excessive, the second machine can be purchased later. Some sales would be lost, however, because the lead time for delivery of this type of machine is six months. In addition, the cost per machine will be lower if both machines are purchased at the same time. The probability of low demand is estimated to be 0.30 and that of high demand to be 0.70. The after tax NPV of the benefits from purchasing two machines together is $70,000 i demandi low and $170,000 of demand is high If one machine is purchased and demand is low, the NPV is $120,000. If demand is high, the manager has three options: (1) doing nothing which has an NPV of $100,000; (2) subcontracting, with an NPV of $150,000, and (3) buying the second machine, with an NPV of $140,000 a. Choose the correct decision tree for this problem. Note that each payoff is given in thousands of dollars. Buy 1 machine 100 Low demand 0.30 Low demand -70 Do nothing High demand Subcontract Low demand Buy 2 120 machines High demand 17 Buy 1 machine 150 100 140 High demand 0.70 120 Do nothing Subcontract Buy 2 machines Buy 2 machines Buy 2 machines 150 140 Low demand Click to select your answers) Buy 2 machines Buy 2 machines 140 High demand 170 machines Low demand 0.30 -70 Oc OD Buy 1 machine 100 100 Buy 2 machines 150 150 Low demand 120 Do nothing 0.30 High demand Subcontract 0.70 Low demand Buy 2 -70 machines 0.30 High demand 170 0.70 140 Low demand 0.70 120 Do nothing High demand Subcontract 0.30 Low demand Buy 2 -70 machines 0.70 High demand 170 0.30 140 Buy 2 machines Buy 1 machine b. What is the best decision and what is its expected pavoff? Click to select your answer(s). Oc. OD 100 Buy 1 machine Buy 2 machines 100 Low demand -120 Do nothing 0.30 High demand Subcontract 0.70 Low demand Buy 2 -70 machines 0.30 High demand 170 0.70 -150 140 150 EP Low demand - 120 Do nothing 0.70 High demand Subcontract 0.30 Buy 2 Low demand -70 machines 0.70 High demand 0.30 140 Buy 2 machines Buy 1 machine 170 b. What is the best decision and what is its expected payoff? Best decision is to buy machine(s) and its expected payoff is $ (Enter your responses as integers.) Click to select your answertel

If one machine is purchased and demand is low, the NPV is $120,000. If demand is high, the manager has three options; (1) do nothing, which has an NPV of $100,000; (2) subcontracting, with an NPV of $150,000; and (3) buying the second machine, with an NPV of $140,000.

(a) choose the correct decision tree for this problem know that each payoff is given in thousands of dollars.

(b) what is the best decision and what is its expected payoff?

Best decision is to buy ___ machine(s) and its expected payoff is $____. (Enter response as integer)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock