Question: A marker assembles some segment data from their clients. The accompanying diagram sums up the age-related data they gathered: Age Number of Customers 20-30 72

A marker assembles some segment data from their clients. The accompanying diagram sums up the age-related data they gathered:

Age Number of Customers

20-30 72

30-40 60

40-50 56

50-60 93

?60?60 53

One client is picked aimlessly for a prize giveaway.

What is the likelihood that the client is in any event 30 yet no more seasoned than 60?

What is the likelihood that the client is either more seasoned than 50 or more youthful than 30?

What is the likelihood that the client is at any rate 50?

Assume that in a specific country, the likelihood of having red hair is 0.20, and the likelihood of having blue eyes is 0.30. The likelihood of having the two qualities is 0.06. The probabilities are appeared in the Venn graph, where ?An is the occasion that an arbitrarily picked occupant of this nation has red hair, and ?B is the occasion that a haphazardly picked occupant has blue eyes.

A not B Both B not A

0.14 0.06 0.24

A=0.20 B= 0.30

Figure the restrictive likelihood of an individual having blue eyes given that the person has red hair, and utilize the worth to decide if having blue eyes and red hair are autonomous.

P(B/A=)

Having red hair is? of having blue eyes in light of the fact that?

i11i

a) Market research has shown that 60% of people who are acquainted with a specific item really purchase the item. An arbitrary example of 15 people were acquainted with the item.

I. Characterize the variable of interest for this situation.

ii. What likelihood circulation do you think best depicts the circumstance? Why?

iii. Compute the likelihood that precisely 9 will purchase the item.

iv. On the off chance that 80 people are acquainted with the item, decide the quantity of individual who are required to purchase the item.

b) It is realized that a normal of 5 trains go through Grand Central Terminal like clockwork. Discover the likelihood that

I. Precisely 4 trains will pass in a short time

ii. under 2 trains will pass in 60 minutes

The Chief Information Officer (CIO) at Old Dominion University - ODU-is attempting to improve the college's data network security. The CIO is attempting to assess another interruption discovery innovation on the lookout for a potential trade for the current framework. An interruption recognition framework sounds an "alert" each time conceivable malevolent assault on an organization is identified. The accompanying data is given:

Occasion of interest, A, is an assault

Proof, B, is interruption recognition framework setting off because of abnormal traffic

Likelihood of an assault is 0.01

For the right now introduced situation, the likelihood of a caution given that there is an assault is 0.9, while the likelihood of an alert given there is no assault is 0.25.

For the new innovation, the likelihood of an alert given that there is an assault is 0.8, while the likelihood of a caution given there is no assault is 0.1.

The CIO expects that there are just two sorts of occasions: either there is, or there is no assault.

The CIO is utilizing "proof proportion," depicted as P(B|A)/P(B|A') as an approach to look at the innovations. Kindly assistance the CIO contrast the new innovation and the as of now introduced framework by addressing the accompanying inquiries:

What is proof proportion for the right now introduced situation?

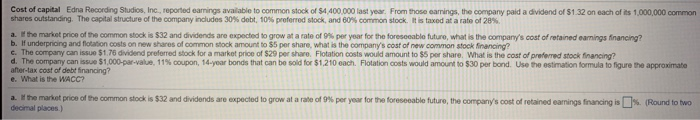

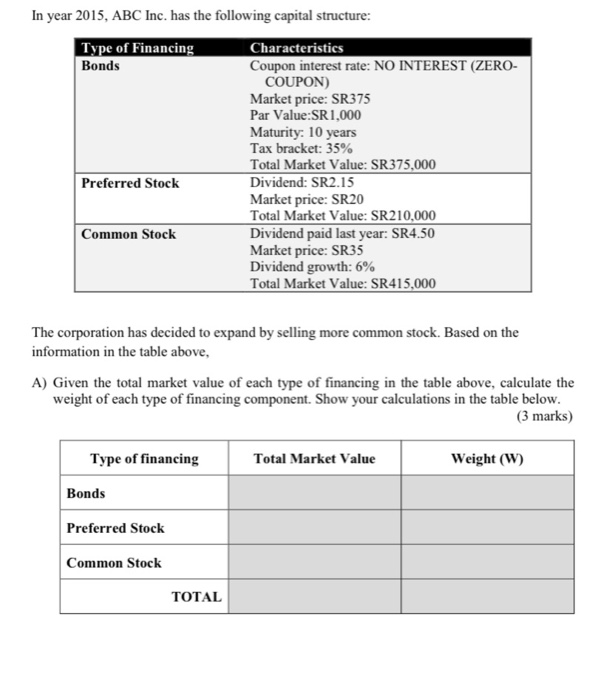

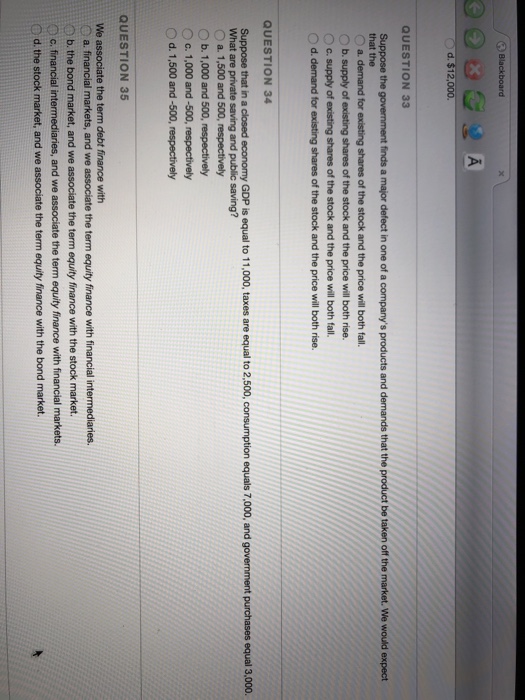

Cost of capital Edna Recording Studios, Inc., reported earnings available to common stock of $4,400 000 last year. From those earnings, the company paid a dividend of $1 32 on each of its 1,000,000 common shares outstanding. The capital structure of the company includes 30%% debt, 10%% proforred stock, and 60%% common stock. It is taxed at a rate of 285. a. If the market price of the common stock is $32 and dividends are expected to grow at a rate of 9%% per year for the foresocable future, what is the company's cost of retained earnings financing? b. If underpricing and flotation coals on new shares of common stock amount to $5 por share, what is the company's cost of new common stock financing? C. The company can issun $1.76 dividend preferred stock for a market price of $29 per share. Flotation costs would amount to $5 por share. What is the cost of preferred stock financing? d. The company can issue $1,000-par-value, 11%% coupon, 14-year bonds that can be sold for $1,210 each. Flotation costs would amount to $30 par bond. Use the estimation formula to figure the approximate after-lax cool of debt financing? . What is the WACC? a. the market price of the common stock is $32 and dividends are expected to grow at a rate of 9% per your for the foreseeable future, the company's cost of retained earnings financing is $. (Round to two decimal places.}In year 2015, ABC Inc. has the following capital structure: Type of Financing Characteristics Bonds Coupon interest rate: NO INTEREST (ZERO- COUPON) Market price: SR375 Par Value:SR.1,000 Maturity: 10 years Tax bracket: 35% Total Market Value: SR375,000 Preferred Stock Dividend: SR2.15 Market price: SR20 Total Market Value: SR210,000 Common Stock Dividend paid last year: SR4.50 Market price: SR35 Dividend growth: 6% Total Market Value: SR415,000 The corporation has decided to expand by selling more common stock. Based on the information in the table above, A) Given the total market value of each type of financing in the table above, calculate the weight of each type of financing component. Show your calculations in the table below. (3 marks) Type of financing Total Market Value Weight (W) Bonds Preferred Stock Common Stock TOTALBlackboard O d. $12,000. QUESTION 33 Suppose the government finds a major defect in one of a company's products and demands that the product be taken off the market. We would expect that the a. demand for existing shares of the stock and the price will both fall. Ob. supply of existing shares of the stock and the price will both rise. O c. supply of existing shares of the stock and the price will both fall. Od. demand for existing shares of the stock and the price will both rise. QUESTION 34 Suppose that in a closed economy GDP is equal to 11,000, taxes are equal to 2,500, consumption equals 7,000, and government purchases equal 3,000. What are private saving and public saving? a 1,500 and 500, respectively b. 1,000 and 500, respectively Oc. 1,000 and -500, respectively Od. 1,500 and -500, respectively QUESTION 35 We associate the term debt finance with a. financial markets, and we associate the term equity finance with financial intermediaries. b. the bond market, and we associate the term equity finance with the stock market. (c, financial intermediaries, and we associate the term equity finance with financial markets. d. the stock market, and we associate the term equity finance with the bond market.The Company had quite a few changes during the past year. The changes for their different balance sheet items from last year to this year were (the changes in parentheses are declines; otherwise the changes are increases): $3,200 for Receivables; $2,500 for Payables; ($4,800) for Cash; $5,300 for Short-term Notes Payable; $7,400 for Plant, Property, & Equipment; and $7,500 for Long-Term Debt. Which statement is most accurate? 0 The change in net working capital is ($17,700) and represents a use of financing 0 The change in net working capital is ($9,400) and represents a use of financing 0 The change in net working capital is ($15,400) and represents a use of financing 0 The change in net working capital is ($17,700) and represents a source of nancing 0 The change in net working capital is ($9,400) and represents a source of nancing