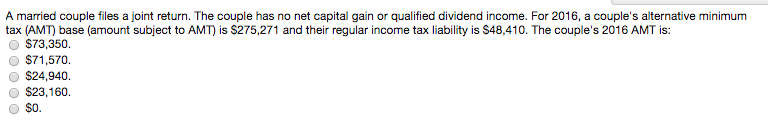

Question: A married couple files a joint return. The couple has no net capital gain or qualified dividend income. For 2016, a couple's alternative minimum tax

A married couple files a joint return. The couple has no net capital gain or qualified dividend income. For 2016, a couple's alternative minimum tax (AM) base (amount subject to AMT) is $275,271 and their regular income tax liability is $48,410. he couple's 2016 AMT is: $73,350, $71,570, $24,940, $23,160 O $0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts