Question: A mining company is deciding whether to open a strip mine with an initial outlay at t = 0 of $2.5 million. Cash inflows of

|

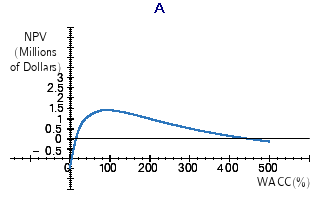

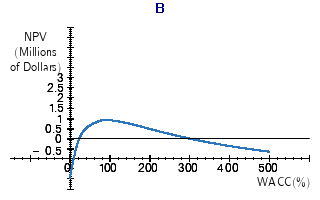

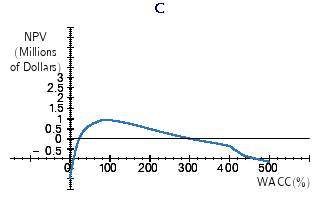

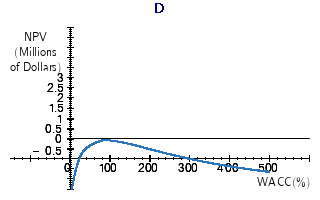

A mining company is deciding whether to open a strip mine with an initial outlay at t = 0 of $2.5 million. Cash inflows of $13 million would occur at the end of Year 1. The land must be returned to its natural state so there is a cash outflow of $12.5 million, payable at the end of Year 2.

|

NPV Millions of Dollars 3 2.5 2 1.5 0.5 0 0.5 100 200 300 400 500 WA CC % B NPV Millions of Dollars 3 2.5 2 1.5 1 0.5 0 0.5 100 200 300 400 500 WA CC % ***** C NPV Millions of Dollars 3 2.5 2 1.5 1 0.5 0 0.5 100 200 300 400 500 WA CC % ***** D NPV Millions of Dollars 3 2.5 2 1.5 1 0.5 0.5 100 200 300 1 200__500 WA CC(%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts