Question: A mining company is deciding whether to open a strip mine with an initial outlay at t -0 of $1.5 million. Cash inflows of $13.5

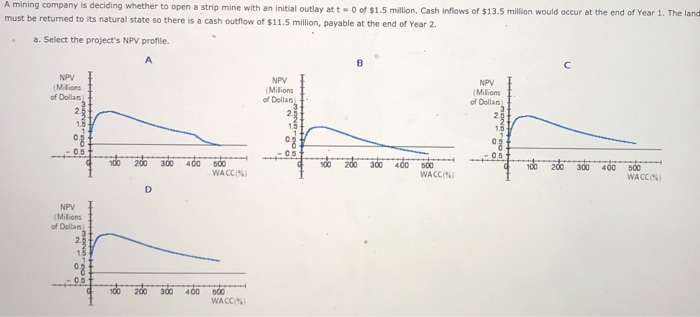

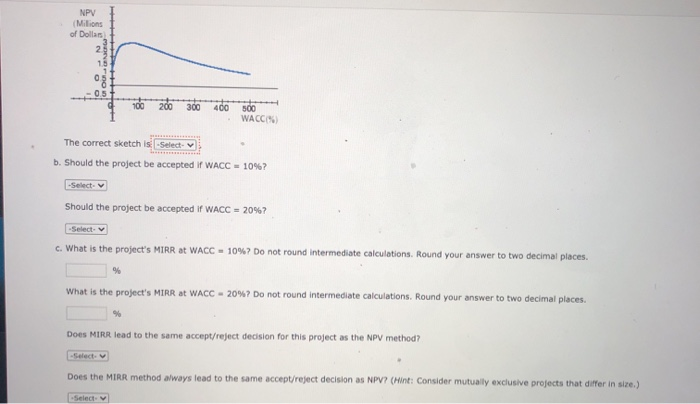

A mining company is deciding whether to open a strip mine with an initial outlay at t -0 of $1.5 million. Cash inflows of $13.5 million would occur at the end of Year 1. The land must be returned to its natural state so there is a cash outflow of $11.5 million, payable at the end of Year 2. a. Select the project's NPV profile. NPV Millions of Dolls 2 1.5 NPV Milions of Dallas 23 1.5 NPV Milions of Dollars 15 08 05 0.5 100 200 300 400 100 500 WACCS 200 300 400 100 SOO WACCO 200 300 400 500 WACCS D NPV (Milions of Dollars 23 100200 300 400 500 WACCA NPV Milions of Dollars 2 15 0.5 100 200 300 400 500 WACCI% The correct sketch is: -Select- b. Should the project be accepted If WACC - 10%? -Select Should the project be accepted if WACC - 20%? -Select- c. What is the project's MIRR at WACC - 10%? Do not round intermediate calculations. Round your answer to two decimal places. % What is the project's MIRR at WACC - 20%? Do not round intermediate calculations. Round your answer to two decimal places. Does MIRR lead to the same accept/reject decision for this project as the NPV method? Does the MIRR method always lead to the same accept/reject decision as NPV? (Hint: Consider mutually exclusive projects that differ in size) Select

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts