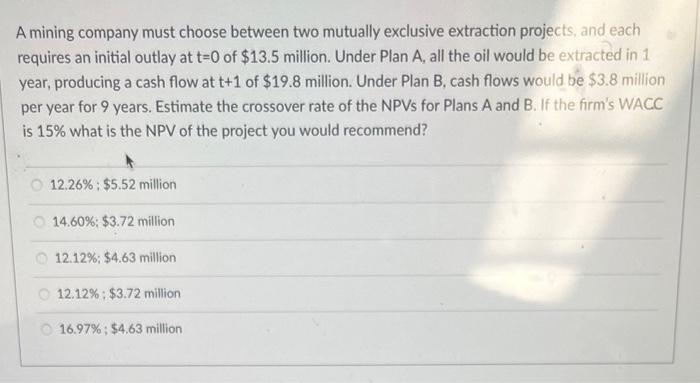

Question: A mining company must choose between two mutually exclusive extraction projects, and each requires an initial outlay at t=0 of $13.5 million. Under Plan A,

A mining company must choose between two mutually exclusive extraction projects, and each requires an initial outlay at t=0 of $13.5 million. Under Plan A, all the oil would be extracted in 1 year, producing a cash flow at t+1 of $19.8 million. Under Plan B, cash flows would be $3.8 million per year for 9 years. Estimate the crossover rate of the NPVs for Plans A and B. If the firm's WACC is 15% what is the NPV of the project you would recommend? 12.26%: $5.52 million 14.60%: $3.72 million 12.12%; $4.63 million 12.12%: $3.72 million 16.97%: $4.63 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts