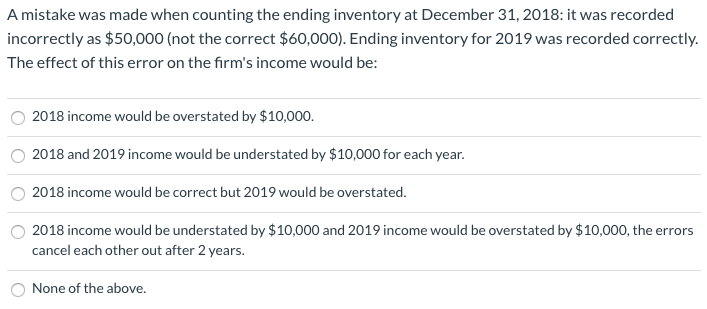

Question: A mistake was made when counting the ending inventory at December 31, 2018: it was recorded incorrectly as $50,000 (not the correct $60,000). Ending inventory

A mistake was made when counting the ending inventory at December 31, 2018: it was recorded incorrectly as $50,000 (not the correct $60,000). Ending inventory for 2019 was recorded correctly. The effect of this error on the firm's income would be: 2018 income would be overstated by $10,000. 2018 and 2019 income would be understated by $10,000 for each year. 2018 income would be correct but 2019 would be overstated. 2018 income would be understated by $10,000 and 2019 income would be overstated by $10,000, the errors cancel each other out after 2 years. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts