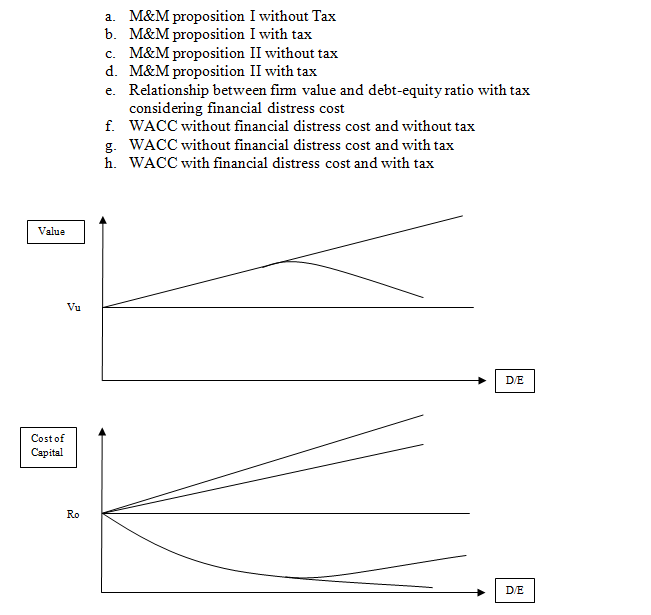

Question: a. M&M proposition I without Tax b. M&M proposition I with tax c. M&M proposition II without tax d. M&M proposition II with tax e.

a. M&M proposition I without Tax

b. M&M proposition I with tax

c. M&M proposition II without tax

d. M&M proposition II with tax

e. Relationship between firm value and debt-equity ratio with tax considering financial distress cost

f. WACC without financial distress cost and without tax

g. WACC without financial distress cost and with tax

h. WACC with financial distress cost and tax

a. M&M proposition I without Tax b. M&M proposition I with tax c. M&M proposition II without tax d. M&M proposition II with tax e. Relationship between firm value and debt-equity ratio with tax considering financial distress cost f. WACC without financial distress cost and without tazx g. WACC without financial distress cost and with tax h. WACC with financial distress cost and with tax Value Vu DE Cost of Capital Ro D/E a. M&M proposition I without Tax b. M&M proposition I with tax c. M&M proposition II without tax d. M&M proposition II with tax e. Relationship between firm value and debt-equity ratio with tax considering financial distress cost f. WACC without financial distress cost and without tazx g. WACC without financial distress cost and with tax h. WACC with financial distress cost and with tax Value Vu DE Cost of Capital Ro D/E

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts