Question: A model for estimating the probability of debt rescheduling (Ri) is given as follows: Ri=0.32 DSR +0.52 IR -0.08 INVR + 0.67 VAREX +0.78 MG

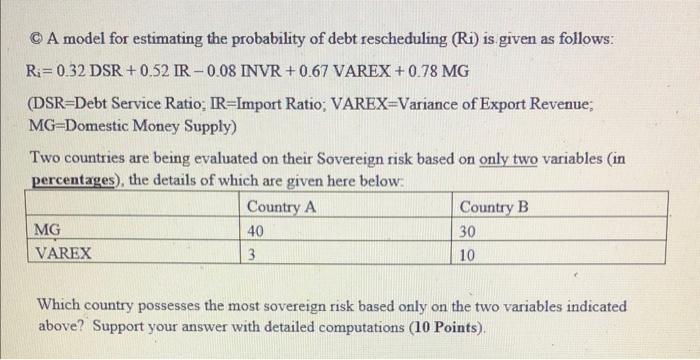

A model for estimating the probability of debt rescheduling (Ri) is given as follows: Ri=0.32 DSR +0.52 IR -0.08 INVR + 0.67 VAREX +0.78 MG (DSR=Debt Service Ratio: IR=Import Ratio; VAREX=Variance of Export Revenue; MG=Domestic Money Supply) Two countries are being evaluated on their Sovereign risk based on only two variables (in percentages), the details of which are given here below: Country A Country B MG 40 30 VAREX 3 10 Which country possesses the most sovereign risk based only on the two variables indicated above? Support your answer with detailed computations (10 Points) A model for estimating the probability of debt rescheduling (Ri) is given as follows: Ri=0.32 DSR +0.52 IR -0.08 INVR + 0.67 VAREX +0.78 MG (DSR=Debt Service Ratio: IR=Import Ratio; VAREX=Variance of Export Revenue; MG=Domestic Money Supply) Two countries are being evaluated on their Sovereign risk based on only two variables (in percentages), the details of which are given here below: Country A Country B MG 40 30 VAREX 3 10 Which country possesses the most sovereign risk based only on the two variables indicated above? Support your answer with detailed computations (10 Points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts