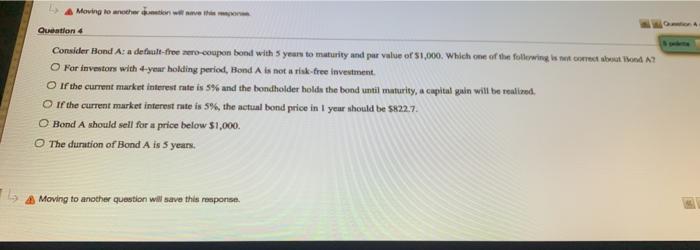

Question: A Moving to another over the warm Question 4 Consider Bond As a default-froe zero-coupon bond with 5 years to muturity and per value of

A Moving to another over the warm Question 4 Consider Bond As a default-froe zero-coupon bond with 5 years to muturity and per value of $1,000. Which one of the following is not correct wordt ond A? For investors with 4-year holding period, Hond A is not a risk-free investment. of the current market interest rate is 5% and the bondholder hold the bond until maturity, a capital gain will be realized. of the current market interest rate is 5%, the actual bond price in I your should be $822.7. O Bond A should sell for a price below $1,000. The duration of Bond A is 5 years 4 Moving to another question will save the response

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts