Question: > A Moving to another question will save this response. Question 23 A box spread is constructed using the following options: 1. European put with

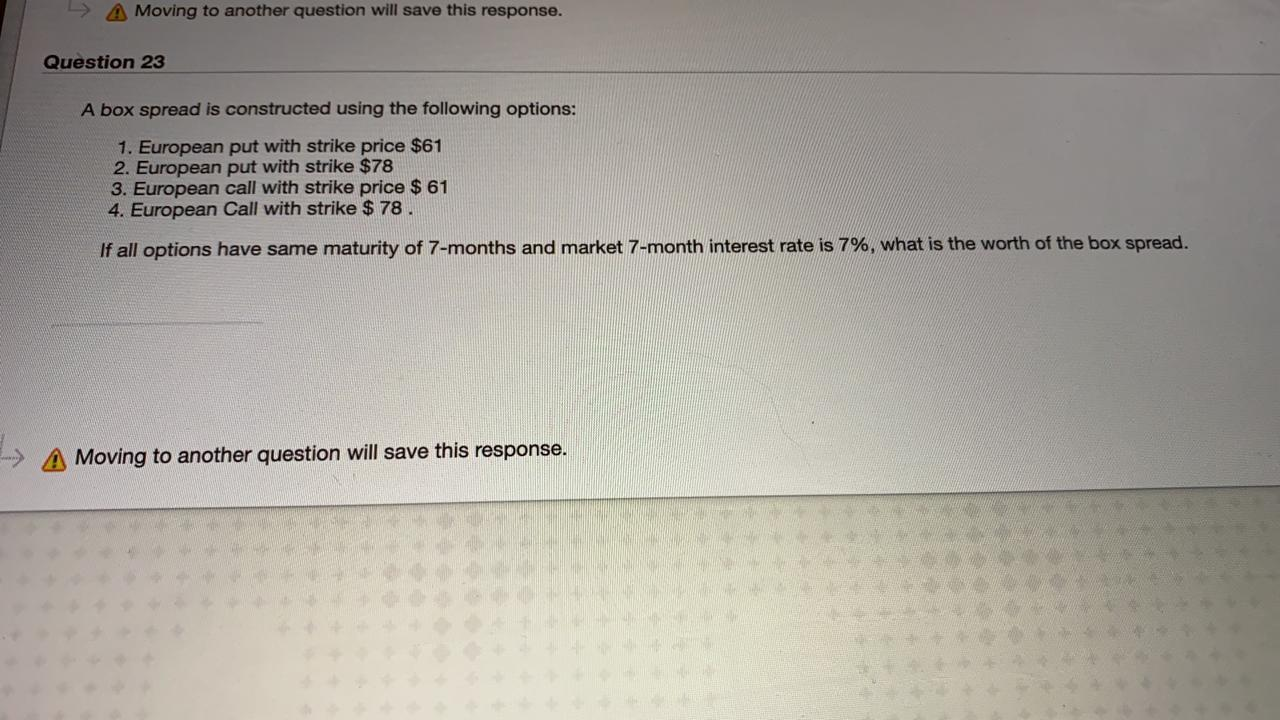

> A Moving to another question will save this response. Question 23 A box spread is constructed using the following options: 1. European put with strike price $61 2. European put with strike $78 3. European call with strike price $ 61 4. European Call with strike $ 78 If all options have same maturity of 7-months and market 7-month interest rate is 7%, what is the worth of the box spread. A Moving to another question will save this response. Question 24 In the previous question, how did you compute payoff of strategy? What are the long and short positions in strategy? TTTF Paragraph, Arial 3 (12pt) ' , fx Mashups HI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts