Question: > A Moving to another question will save this response. 3.90625 points Save Answer A fast growing firm paid a dividend of $1.49 per share

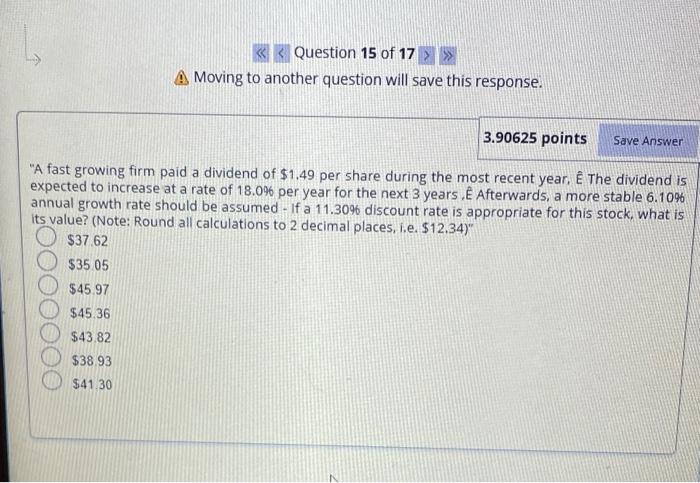

> A Moving to another question will save this response. 3.90625 points Save Answer "A fast growing firm paid a dividend of $1.49 per share during the most recent year. The dividend is expected to increase at a rate of 18.0% per year for the next 3 years Afterwards, a more stable 6.10% annual growth rate should be assumed - If a 11.30% discount rate is appropriate for this stock, what is its value? (Note: Round all calculations to 2 decimal places, i.e. $12.34)" $37.62 $35.05 $45.97 $45.36 $43.82 $38.93 $41.30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts