Question: A Moving to another question will save this response. Question 1 At a volume of 3,000 units, Rudy Inc. reported the following: Sales $2,400,000 Variable

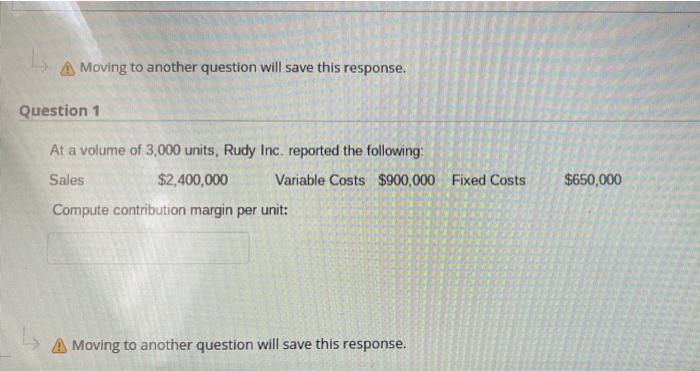

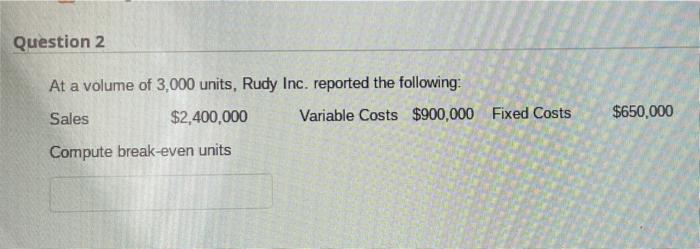

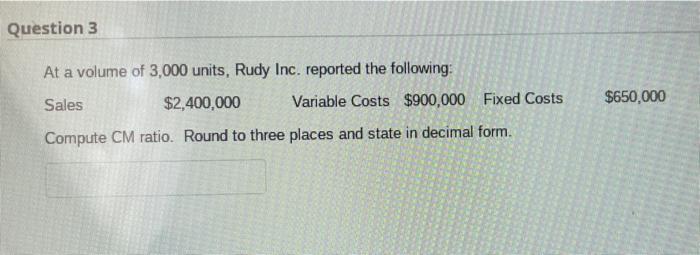

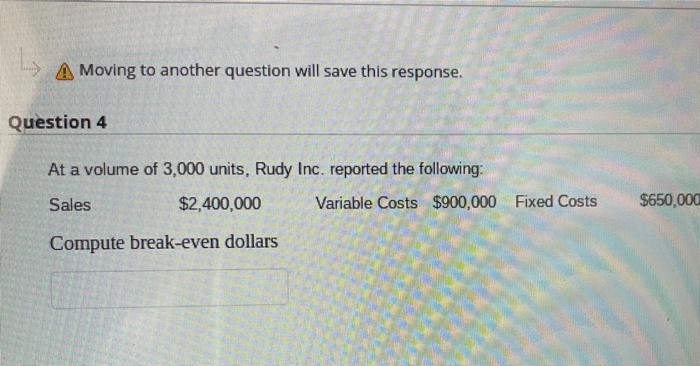

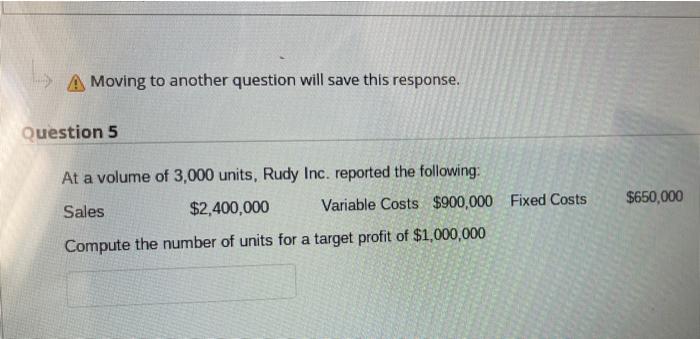

A Moving to another question will save this response. Question 1 At a volume of 3,000 units, Rudy Inc. reported the following: Sales $2,400,000 Variable Costs $900,000 Fixed Costs Compute contribution margin per unit: $650,000 A Moving to another question will save this response. Question 2 At a volume of 3,000 units, Rudy Inc. reported the following: Sales $2,400,000 Variable Costs $900,000 Fixed Costs Compute break-even units $650,000 Question 3 At a volume of 3,000 units, Rudy Inc. reported the following: Sales $2,400,000 Variable Costs $900,000 Fixed Costs $650,000 Compute CM ratio. Round to three places and state in decimal form. ... A Moving to another question will save this response. Question 4 At a volume of 3,000 units, Rudy Inc. reported the following: Sales $2,400,000 Variable Costs $900,000 Fixed Costs $650,000 Compute break-even dollars A Moving to another question will save this response. Question 5 At a volume of 3,000 units, Rudy Inc. reported the following: Sales $2,400,000 Variable Costs $900,000 Fixed Costs $650,000 Compute the number of units for a target profit of $1,000,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts