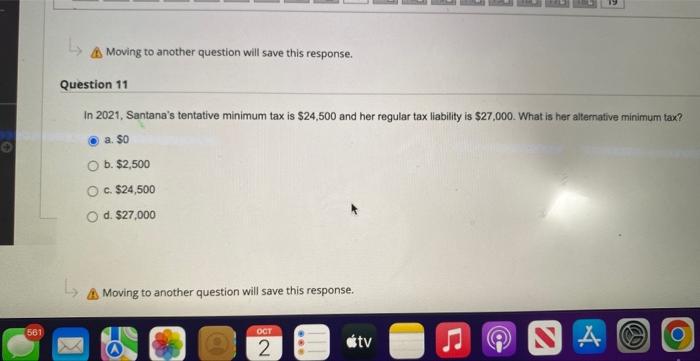

Question: A Moving to another question will save this response. Question 11 In 2021, Santana's tentative minimum tax is $24,500 and her regular tax llability is

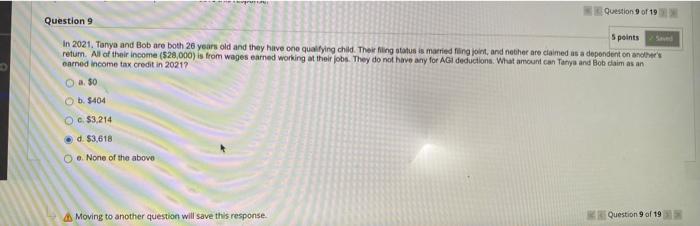

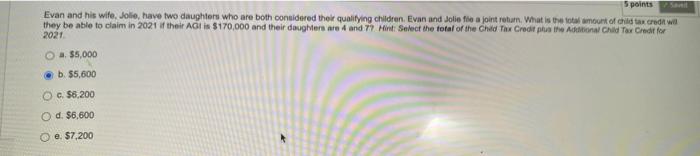

A Moving to another question will save this response. Question 11 In 2021, Santana's tentative minimum tax is $24,500 and her regular tax llability is $27,000. What is her altemative minimum tax? a. $0 b. $2,500 c. $24,500 d. 527,000 A Moving to another question will save this response. In 2021. Tanya and Bob are both 26 years old and they hive one qualifing child. Their filng otatus is macried firing joint, and nebher are ciaimed as a depondent on anolhers retum. All of their income (528,000) is from wages earned working at their fobs. They do not have any for AGi deductions. What amount can Tarya and Bob taim as an enered income tax credit in 20217 a. 50 b. $404 c. $3,214 d. 53,618 e. None of the abowe do Moving to another question will save this response. Question 9 of 19 Evan and his wife. Jolie, have two daughters who are both ooneidered their qualifying chlildren. Evan and Jolie fise a joint retarn. What is the iotal amourt of oilit tax credit wai 2021 a. 35,000 b. 55,600 c. 58,200 d. $6,600 e. 57,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts