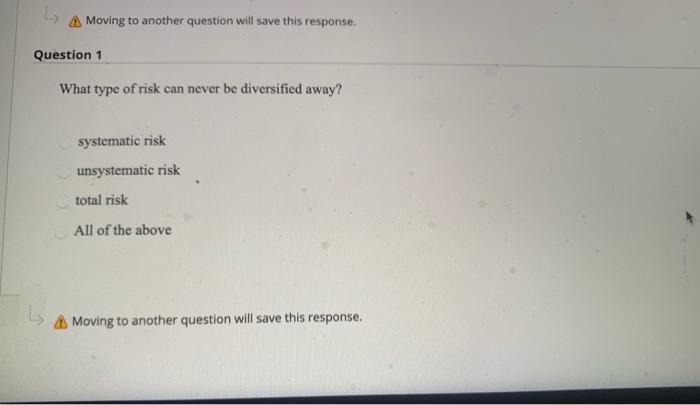

Question: A Moving to another question will save this response. Question 1 What type of risk can never be diversified away? systematic risk unsystematic risk total

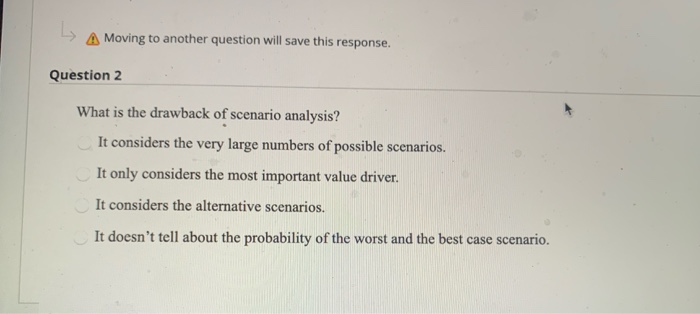

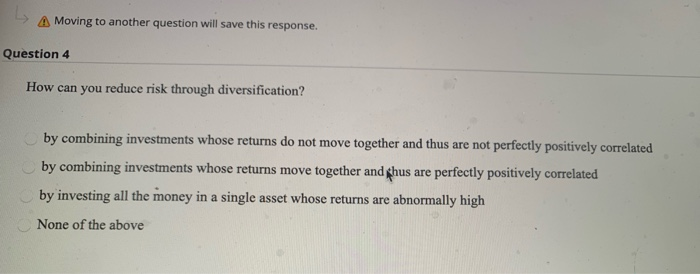

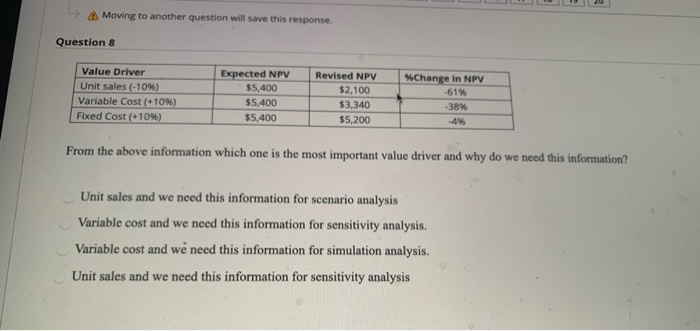

A Moving to another question will save this response. Question 1 What type of risk can never be diversified away? systematic risk unsystematic risk total risk All of the above A Moving to another question will save this response. L A Moving to another question will save this response. Question 2 What is the drawback of scenario analysis? It considers the very large numbers of possible scenarios. It only considers the most important value driver. It considers the alternative scenarios. It doesn't tell about the probability of the worst and the best case scenario. A Moving to another question will save this response. Question 4 How can you reduce risk through diversification? by combining investments whose returns do not move together and thus are not perfectly positively correlated by combining investments whose returns move together and thus are perfectly positively correlated by investing all the money in a single asset whose returns are abnormally high None of the above Moving to another question will save this response. Question 8 Value Driver Unit sales (-10%) Variable Cost (10%) Fixed Cost (+10%) Expected NPV $5,400 $5,400 $5,400 Revised NPV $2,100 $3,340 $5,200 %Change in NPV -61% -38% -4% From the above information which one is the most important value driver and why do we need this information? Unit sales and we need this information for scenario analysis Variable cost and we need this information for sensitivity analysis. Variable cost and we need this information for simulation analysis. Unit sales and we need this information for sensitivity analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts