Question: A Moving to another question will save this response. Question 405 Question 4 5 points Suppose that Rak ceramics Company forecasted its next year's net

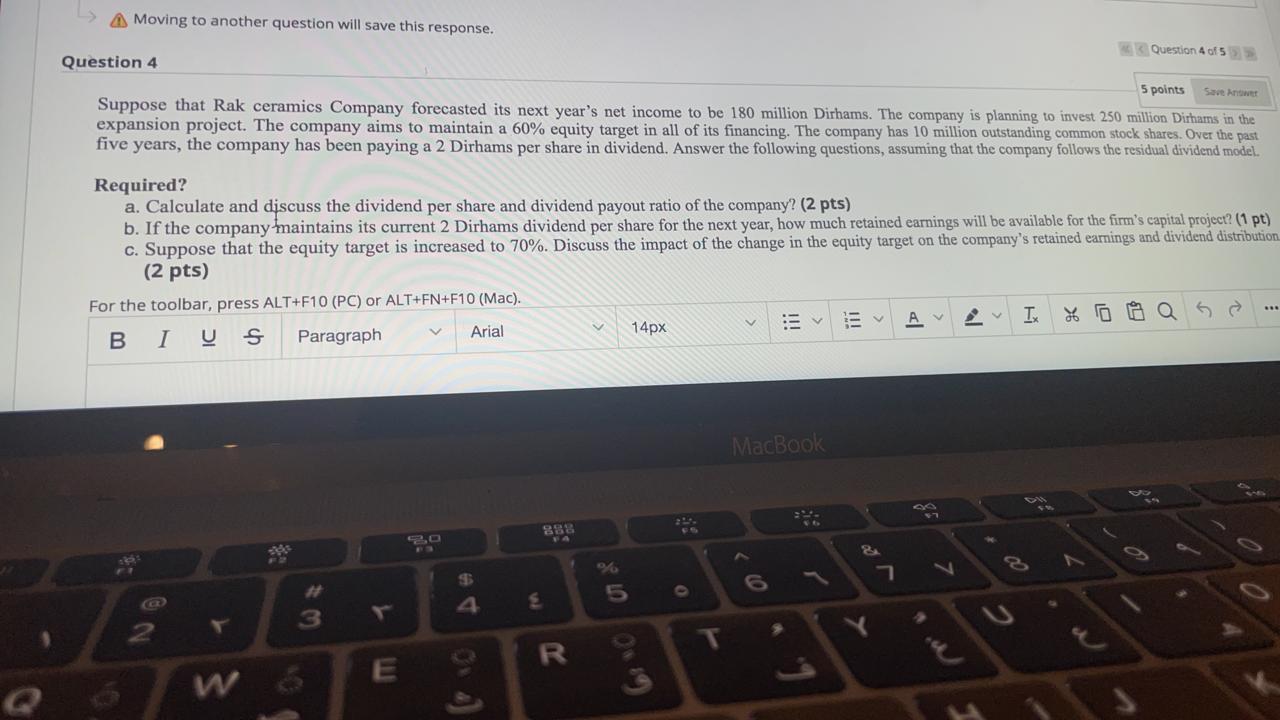

A Moving to another question will save this response. Question 405 Question 4 5 points Suppose that Rak ceramics Company forecasted its next year's net income to be 180 million Dirhams. The company is planning to invest 250 million Dirhams in the expansion project. The company aims to maintain a 60% equity target in all of its financing. The company has 10 million outstanding common stock shares. Over the past five years, the company has been paying a 2 Dirhams per share in dividend. Answer the following questions, assuming that the company follows the residual dividend model. Save an Required? a. Calculate and discuss the dividend per share and dividend payout ratio of the company? (2 pts) b. If the company maintains its current 2 Dirhams dividend per share for the next year, how much retained earnings will be available for the firm's capital project? (1 pt) c. Suppose that the equity target is increased to 70%. Discuss the impact of the change in the equity target on the company's retained earnings and dividend distribution (2 pts) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). T. B I U Paragraph Arial 14px MacBook 898 % 5 3 R E

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts