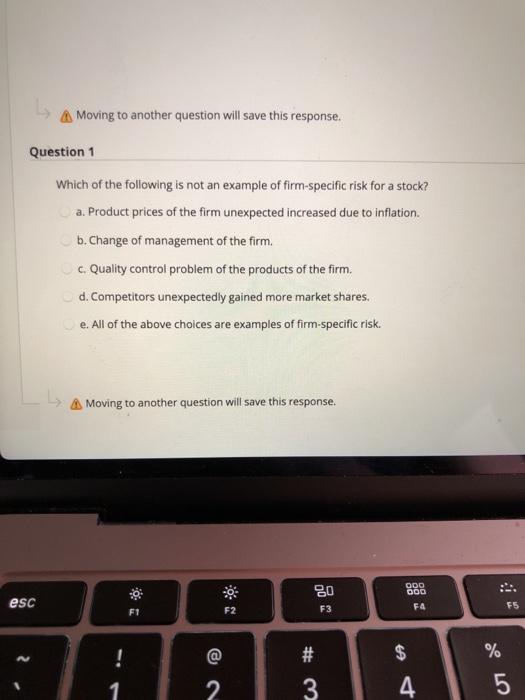

Question: A Moving to another question will save this response. Question 1 Which of the following is not an example of firm-specific risk for a stock?

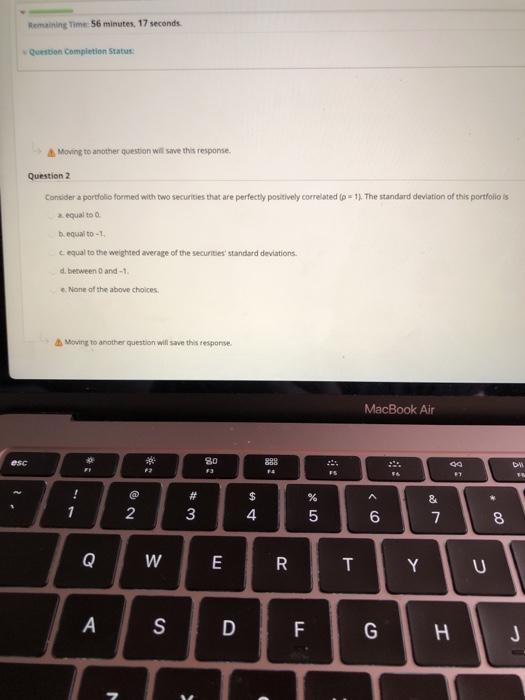

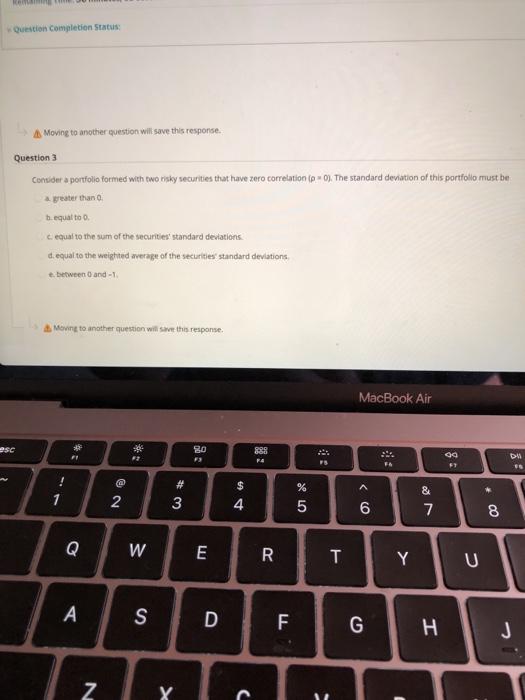

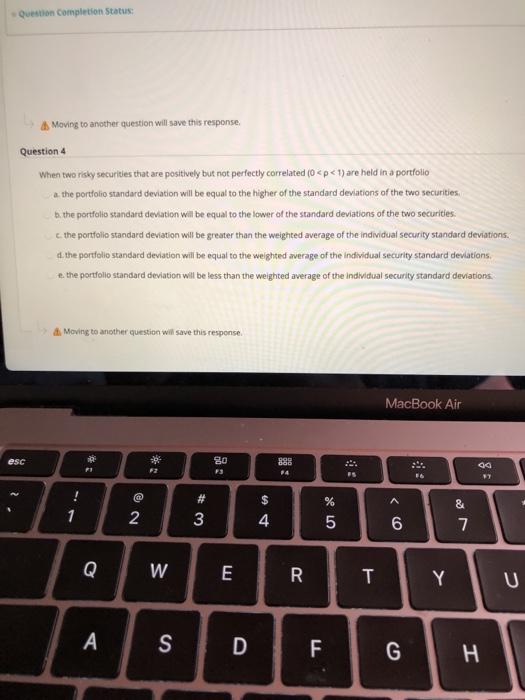

A Moving to another question will save this response. Question 1 Which of the following is not an example of firm-specific risk for a stock? a. Product prices of the firm unexpected increased due to inflation. b. Change of management of the firm. c Quality control problem of the products of the firm. d. Competitors unexpectedly gained more market shares. e. All of the above choices are examples of firm-specific risk. Moving to another question will save this response. ODO 000 esc 80 F3 F5 FA F1 F2 ! $ % #n 1 2 4 5 Remaining Time 56 minutes, 17 seconds Question Completion Status: Moving to another question will save this response. Question 2 Consider a portfolio formed with two securities that are perfectly positively correlated (p = 1. The standard deviation of this portfolio is 2. equal to 1. equal to - cequal to the weighted average of the securities standard deviations d. between 0 and -1 6. None of the above choices Moving to another question will save this response MacBook Air esc 80 888 FO 21 FS 12 :8 6 A & 1 2 $ 4 3 % 5 6 7 8 W E R T Y U A S D F G H J Question completion Status: Moving to another question will save this response. Question 3 Consider a portfolio formed with two risky securities that have zero correlation to the standard deviation of this portfolio must be a greater than b.equal to c. equal to the sum of the securities standard deviations d. equal to the weighted average of the securities standard deviations between 0 and 1 Moving to another question will see the response MacBook Air esc 80 FS FI 2 09 Du P4 PS 1 @ 2 # 3 $ 4 % 5 & 7 6 8 Q W E R T Y S D F G H J Z x C 17 Question completion Status: Moving to another question will save this response Question 4 When two risky securities that are positively but not perfectly correlated (0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts