Question: A Moving to another question will save this response. Question 1 During 2019 GoPro's total current liabilities decreased by $27,552 (in thousands). O True O

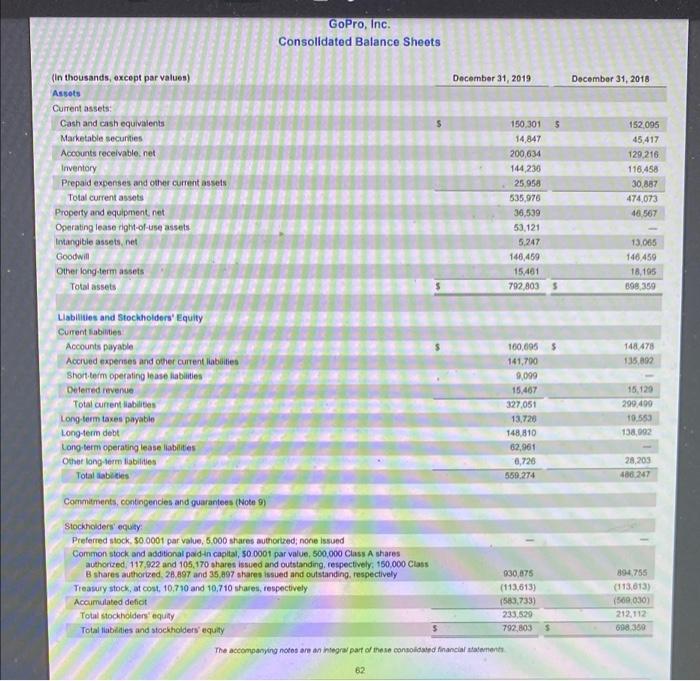

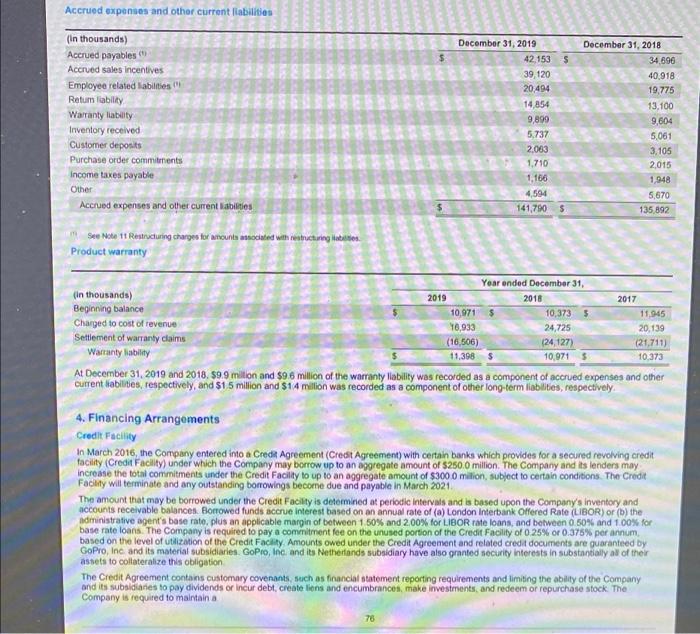

A Moving to another question will save this response. Question 1 During 2019 GoPro's total current liabilities decreased by $27,552 (in thousands). O True O False Moving to another question will save this response. GoPro, Inc. Consolidated Balance Sheets December 31, 2019 December 31, 2018 5 (In thousands, except par values) Assets Current assets: Cath and cash equivalents Marketable securities Accounts receivable.net Inventory Prepaid expenses and other current assets Total current assets Property and equipment net Operating lease right-of-use assets Intangible assets, net Goodwin Other long-term assets Total assets 150.301 14,847 200 634 144 236 25 950 535,970 36,539 53,121 5.247 146,459 15.401 792 803 152 095 45.417 129.216 116.458 30.887 474,073 48 567 13.065 140.459 18,195 698350 $ 148478 135,892 Llabilities and Stockholders' Equity Current liabilities Accounts payable Accrued expertes and other current liabilities Shortbom operating teuse labilities Deferred revenue Total current liabilities Long term taxes payable Long-term debt Long term operating lease liabilities Othat long term Habilities Total sabes Commitments, contingencies and guarantees (Note 9) 100.695 141,700 9,099 15,407 327051 13.720 148,810 62,961 6,726 550.274 15.129 299.400 10.553 138,092 28,203 486 247 Stockholders equity Preferred stock. 50.0001 par value, 5.000 shares authorized; nonio issund Common stock and additional pad-in capital, 50.0001 par value, 500,000 Class A shares authorized, 117,922 and 105,170 shares issued and outstanding, respectively 150.000 Class B shares authorized 28.897 and 35,897 stares issued and outstanding, respectively 30,875 Treasury stock, at cont. 10.710 and 10.710 res, respectively (113.613) Accumulated defit 1583.733) Total stockholders' equiry 233.520 Total lobilities and stockholders' equity 792,8035 The accompanying notes are an integral part of these consolidated financial stats 894.755 (113,013) 1500030) 212,112 698350 62 Accrued expenses and other current liabilities (In thousands) Accrued payables Accrued sales incentives Employee related abilities Ralum liability Warranty liability Inventory received Customer deposits Purchase order commitments Income taxes payable Other Accrued expenses and other current liabilities December 31, 2019 42.153 s 39,120 20.494 14,854 9,899 5,737 2,083 1.710 1,186 4,594 141,790 5 December 31, 2018 34,696 40,918 19,775 13.100 9,604 5,061 3,105 2015 1,948 5,670 135,892 See Note 11 Restructuring charges for mounts associated with restructuring Product warranty 2017 Year onded December 31, (in thousands) 2019 2018 Beginning balance 10,971 $ 10,373 $ 11.945 Charged to cost of revenue 16,933 24,725 20,139 Settlement of warranty claims (16,506) 124, 127) (21,711) Warranty liability 11,398 $ 10,9715 10.373 At December 31, 2019 and 2018. 89.9 million and $9.6 million of the warranty ability was recorded as a component of accrued expenses and other current debildes, respectively, and $15 million and $14 million was recorded as a component of other long-term liabilities, respectively 4. Financing Arrangements Credit Facility In March 2016, the Company entered into a Credit Agreement (Credit Agreement with certain banks which provides for a secured revolving credit facility (Credit Facility) under which the Company may borrow up to an aggregate amount of $250.0 million. The Company and its lenders may increase the total commitments under the Credit Facility to up to an aggregate amount of $3000 million, subject to certain conditions. The Credit Facility will terminate and any outstanding borrowings become due and payable in March 2021 The amount that may be borrowed under the Credit Facility is determined at periodic intervals and is based upon the Company's inventory and accounts receivable balances Borrowed funds accrue interest based on an annual rate of (a) London Interbank Offered Rate (LIBOR) or (b) the Administrative agent's base rato, plus an applicable margin of between 1 50% and 200% for LIBOR rate loans, and between 0.50% and 100% for base rato loans. The Company is required to pay a commitment fee on the unused portion of the Credit Facility of 0.25% or 0.376% per annum based on the level of utilization of the Credit Facility. Amounts owed under the Credit Agreement and related credit documents are guaranteed by GoPro, Inc and its material subsidiaries. GoPro, Inc. and its Netherlands subsidiary have also granted security Interests in substantially all of their assets to collateralize this obligation The Credit Agreement contains customary covenants, such as Marcial statement reporting requirements and limiting the ability of the Company and its subsidianes to pay dividends or incur debt, create lions and encumbrances, make investments, and redeem or repurchase stock The Company is required to maintain a 76

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts