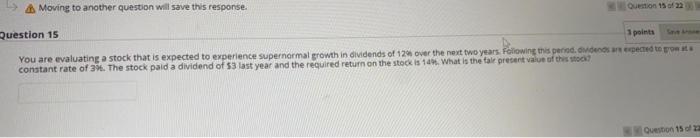

Question: A Moving to another question will save this response. Question 1522 Question 15 1 points You are evaluating a stock that is expected to experience

A Moving to another question will save this response. Question 1522 Question 15 1 points You are evaluating a stock that is expected to experience supernormal growth in dividends of 12 over the next two years. Following this periodserpected to constant rate of 37. The stock paid a dividend of 53 last year and the required return on the stock is 10. What is the fair present value of this to Question 15 of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts