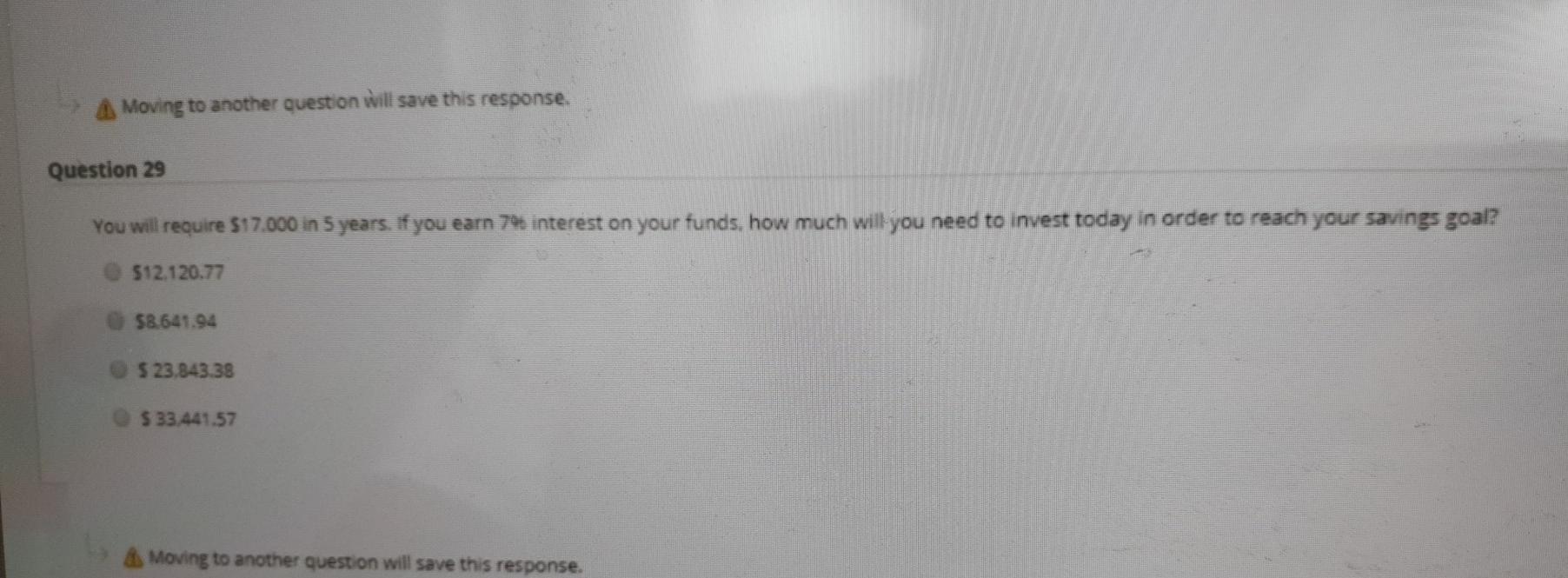

Question: A Moving to another question will save this response. Question 29 You will require 517.000 in 5 years. If you earn 74. interest on your

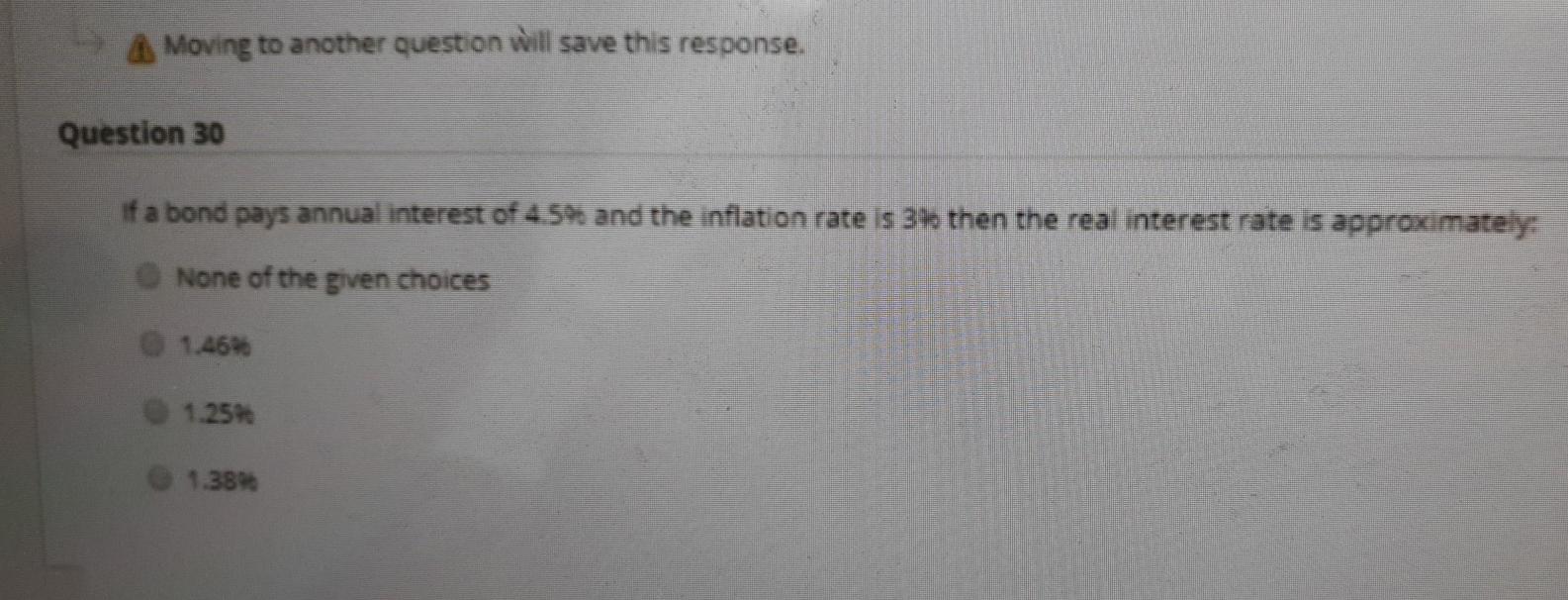

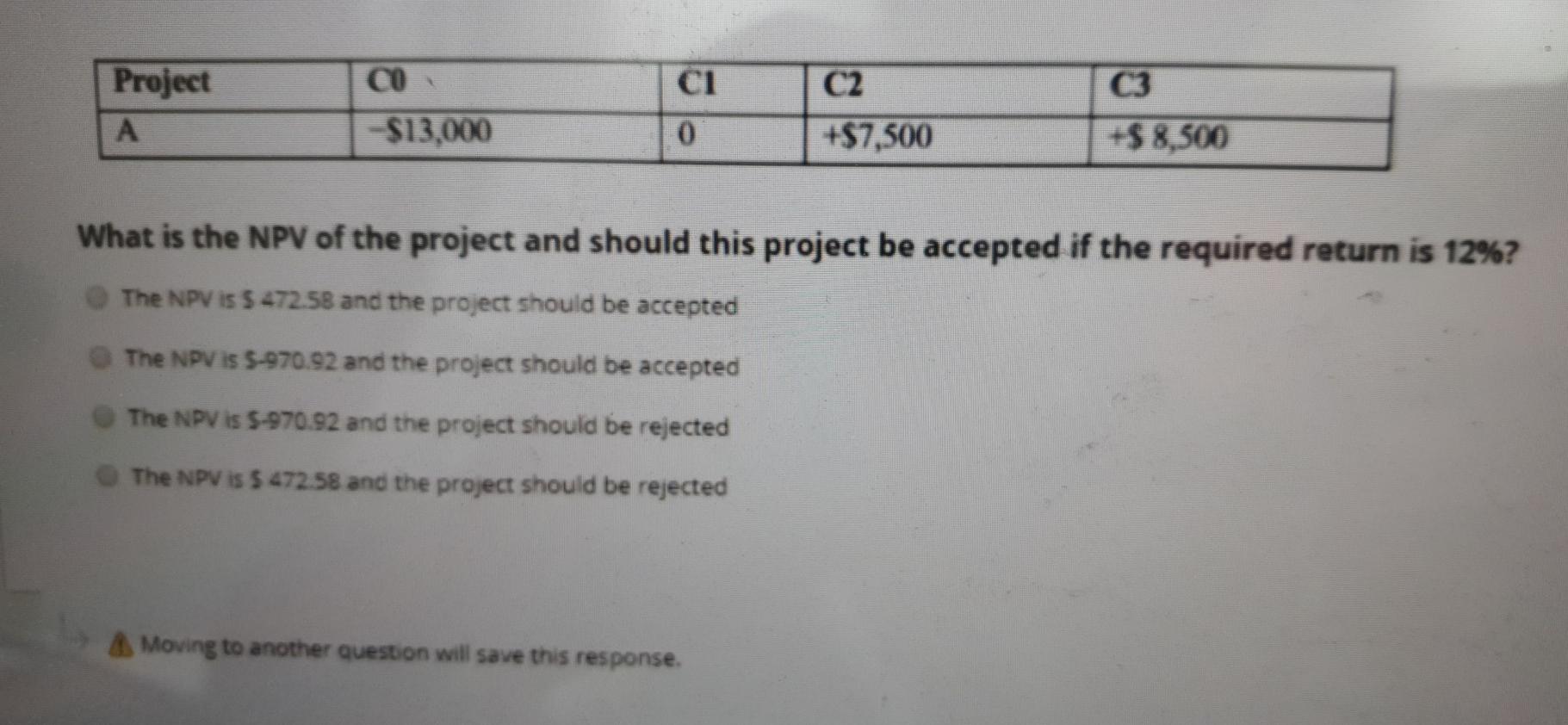

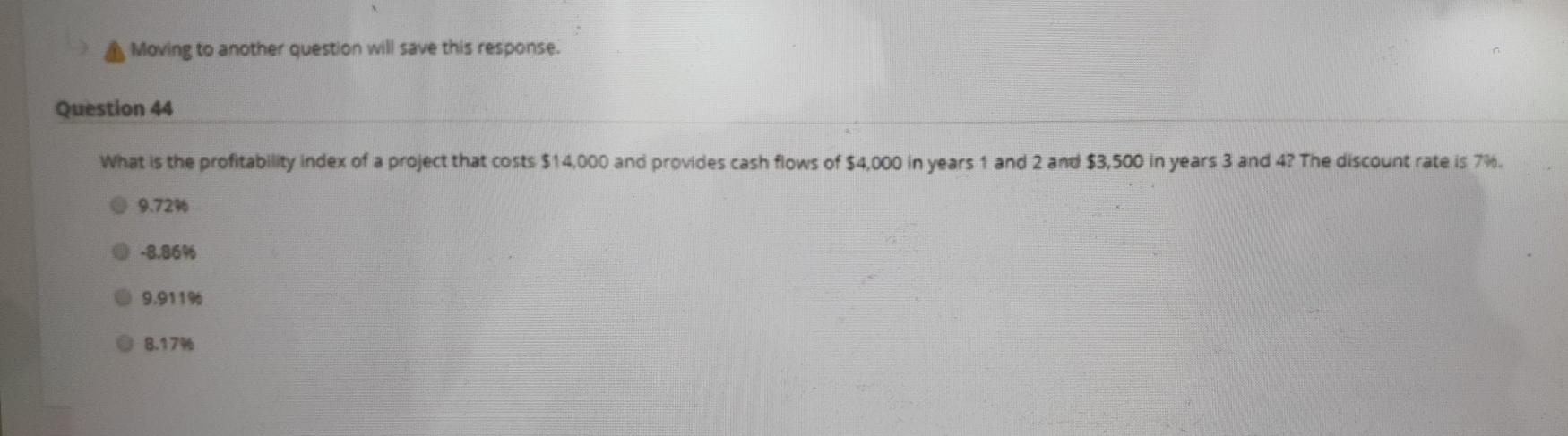

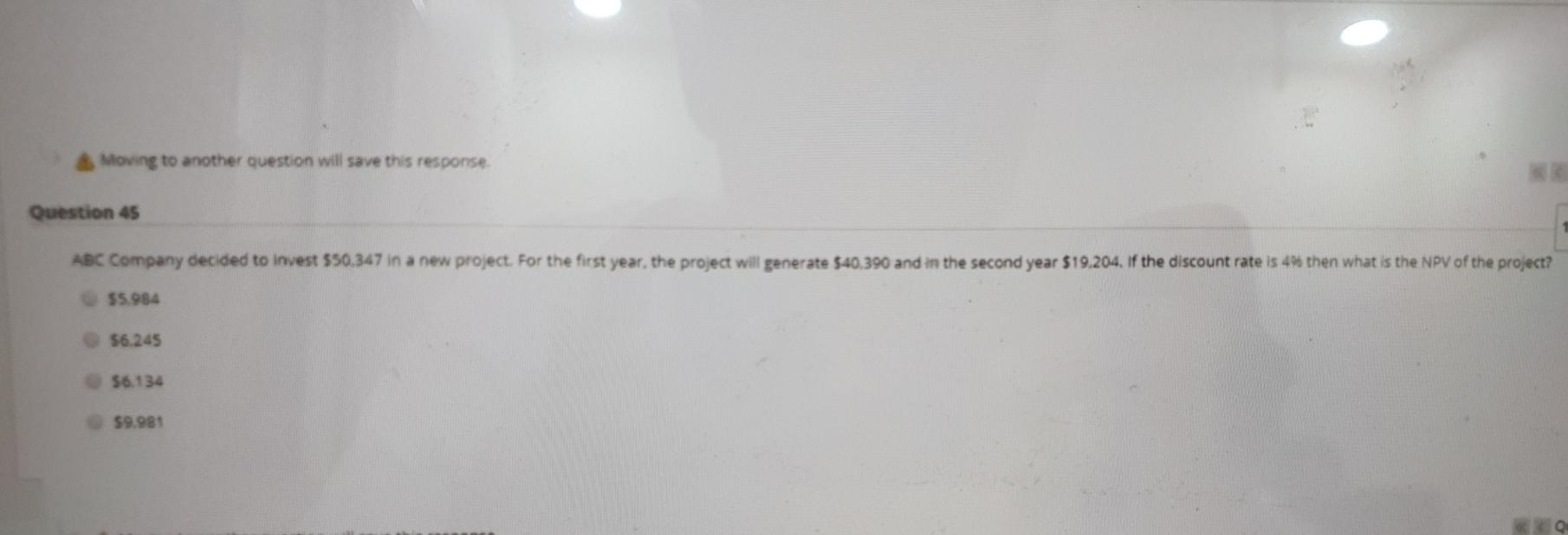

A Moving to another question will save this response. Question 29 You will require 517.000 in 5 years. If you earn 74. interest on your funds, how much will you need to invest today in order to reach your savings goal? $12.120.77 $8.641.94 $23.843.38 $ 33,441.57 A Moving to another question will save this response. 4 Moving to another question will save this response. Question 30 if a bond pays annual interest of 4.596 and the inflation rate is 34 then the real interest rate is approximately: None of the given choices 1.46% 1.254 1.38% CI Project CO -$13,000 C2 +$7,500 C3 +$ 8,500 0 What is the NPV of the project and should this project be accepted if the required return is 12%? The NPV is $ 472.58 and the project should be accepted The NPV is 5-970.92 and the project should be accepted The NPV is 5-970.92 and the project should be rejected The NPV is $ 472.58 and the project should be rejected A Moving to another question will save this response. Moving to another question will save this response. Question 44 What is the profitability index of a project that costs $14,000 and provides cash flows of $4.000 in years 1 and 2 and $3,500 in years 3 and 4? The discount rate is 7%. 9.72 -8.86% 9.9119 8.17 Moving to another question will save this response. Question 45 ABC Company decided to invest 550.347 in a new project. For the first year, the project will generate $40.390 and in the second year $19.204. If the discount rate is 4then what is the NPV of the project? $5.984 56.245 56.134 $9.981

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts