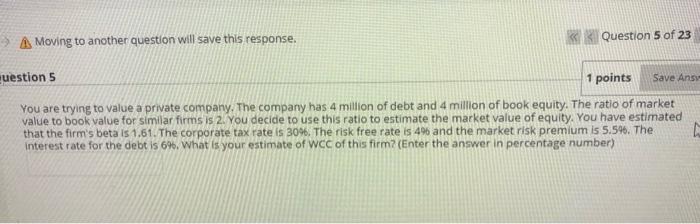

Question: A Moving to another question will save this response. Question 5 of 23 question 5 1 points Save Ansy You are trying to value a

A Moving to another question will save this response. Question 5 of 23 question 5 1 points Save Ansy You are trying to value a private company. The company has 4 million of debt and 4 million of book equity. The ratio of market value to book value for similar firms is 2. You decide to use this ratio to estimate the market value of equity. You have estimated that the firm's beta is 1.61. The corporate tax rate is 30%. The risk free rate is 496 and the market risk premium is 5.596. The Interest rate for the debt is 6%. What is your estimate of WCC of this firm? (Enter the answer in percentage number)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts