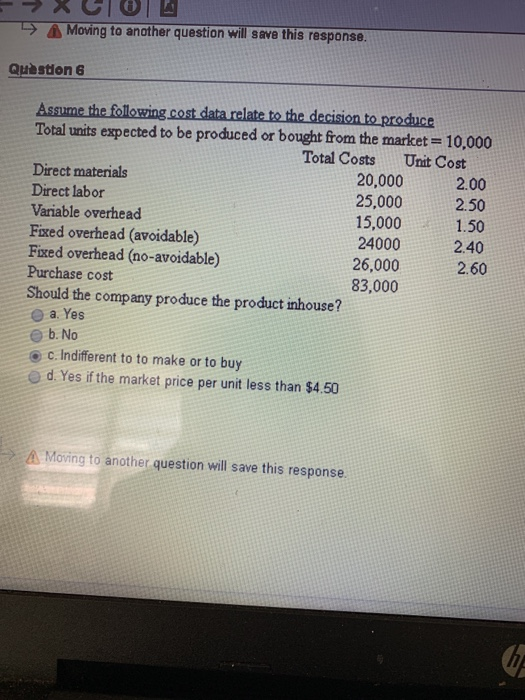

Question: A Moving to another question will save this response. Qustion 6 Assume the following cost data relate to the decision to produce Total units expected

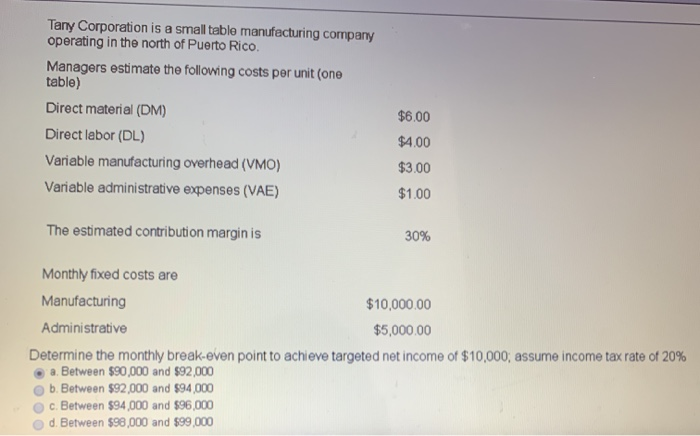

A Moving to another question will save this response. Qustion 6 Assume the following cost data relate to the decision to produce Total units expected to be produced or bought from the market= 10,000 Unit Cost Total Costs 20,000 Direct materials 2.00 Direct labor Variable overhead Fixed overhead (avoidable) Fixed overhead (no-avoidable) Purchase cost Should the company produce the product inhouse? a. Yes 25,000 15,000 24000 2.50 1.50 2.40 26,000 83,000 2.60 b. No c. Indifferent to to make or to buy d. Yes if the market price per unit less than $4.50 A Moving to another question will save this response. Tany Corporation is a small table manufacturing company operating in the north of Puerto Rico. Managers estimate the following costs per unit (one table) Direct material (DM) $6.00 Direct labor (DL) $4.00 Variable manufacturing overhead (VMO) $3.00 Variable administrative expenses (VAE) $1.00 The estimated contribution margin is 30% Monthly fixed costs are Manufacturing $10,000.00 Administrative $5,000.00 Determine the monthly break-even point to achieve targeted net income of $10,000; assume income tax rate of 20% a. Between $90,000 and $92,000 b. Between $92,000 and $94,000 c. Between $94,000 and $96,000 d. Between $98,000 and $99,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts